When Fiserv purchased First Data in 2019, it was part of an industrywide push to combine bank and merchant technology under one roof. A year later, a key piece of First Data’s technology — and its top executive — have become Fiserv’s path through the coronavirus crisis.

Accounting and bookkeeping shed over 67,000 jobs in the month of April, according to the Bureau of Labor Statistics.

A mix of consumer debt and economic anxiety is shining a light on firms that offer alternatives to revolving credit. This, in turn, creates a chance to further tie financing directly to checkout.

One of the selling points behind multi-account payment cards is the ability to shift spending on the fly or shortly after shopping, such as to fund a recent purchase with loyalty points. During the pandemic, this feature may become a key financial management tool.

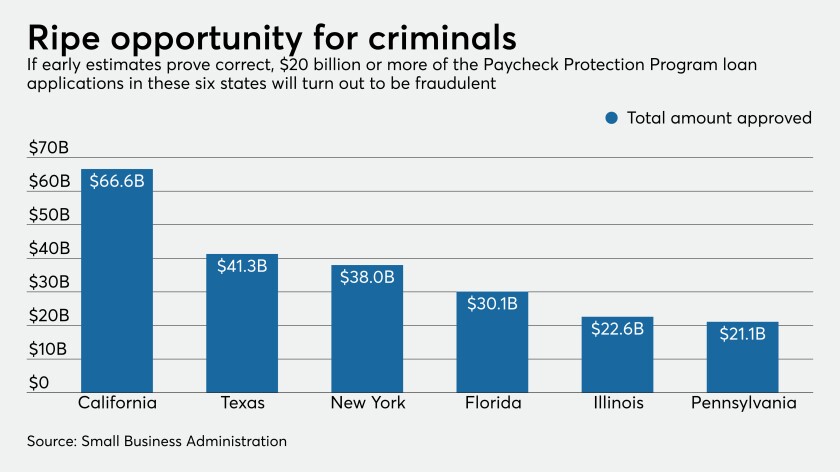

Up to 12% of loans under the $660 billion small-business rescue program could be tied to misleading or completely phony applications, fueling concerns about lenders' potential liability.

The tax prep chain is offering consulting services starting at $99.

The decision, prompted by requests from a bipartisan group of lawmakers, reverses previous IRS guidance.

House Speaker Nancy Pelosi dismissed President Donald Trump’s call for a payroll tax cut and changes in the capital gains tax, saying it wouldn’t help millions of unemployed workers and others struggling in an economy shut down by the pandemic.

New report says hospitals lost a total of $1.44 billion a day between March and mid-April.

Through its partnership with SpringFour, a fintech BMO Harris mentored in 2017, the Chicago bank is referring customers — including many hurt by the pandemic — to reputable nonprofits to help with job training, financial assistance and more.