Bankers are bracing for accusations of discrimination in the way Paycheck Protection Program loans were allocated.

The pandemic is 'turning up the volume' on security risks, according to security experts.

Banks tend to pull back in times of crisis by tightening credit and focusing on collections efforts. But consumers, and not returns, must be the focus during the coronavirus pandemic.

There's a great deal of help for businesses in the CARES Act and the FFCRA.

Consumer remittance behaviors are being forced to change, with senders and recipients moving to mobile wallets, bank accounts, and cards. But many still want cash.

President Donald Trump has fixed his sights on getting a payroll tax cut in the next coronavirus stimulus bill, but it’s unclear whether he can get Republicans — much less Democrats — to go along with such a high-cost item that likely would have only a modest impact on the economy.

Recent breaches and a pandemic-driven strain on cloud computing seemed to prompt a regulatory warning that banks, tech vendors and cloud hosts share an obligation to safeguard customer data — no matter where it resides.

S&P Global Ratings said balancing the state budget "will be met against a growing cloud of uncertainty” between the recession and COVID-19.

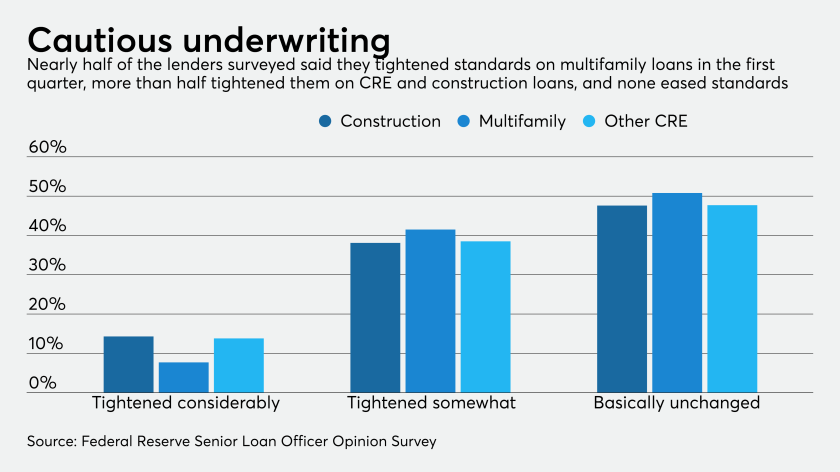

Lenders implemented stricter underwriting across all loan types in the first quarter as the pandemic upended the economy, the Federal Reserve said in its survey of loan officers.

The Fed has tweaked its Main Street Lending Program to stir more enthusiasm, including the creation of a third financing option for larger companies. Will it make a difference?