Small businesses that manage to get their Paycheck Protection Program loans forgiven may find themselves losing valuable tax breaks, according to new guidance from the Internal Revenue Service.

Regulators need to revamp their proposal to overhaul the Community Reinvestment Act now that the coronavirus outbreak has created unforeseen financial needs.

What Maya Angelou can teach us about client communication.

As if tax season isn’t already stressful enough, the coronavirus pandemic is making things that much harder.

The Top 100 Firm has tailored an analytical tool to planning in the pandemic.

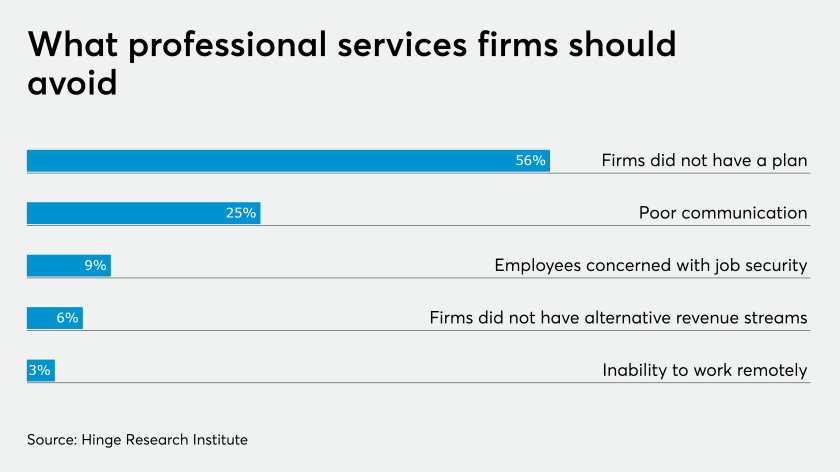

Accounting firms need to become more adaptable in the face of the COVID-19 crisis

Don’t waste the coronavirus crisis: Follow these seven steps to re-evaluate your strategy plan.

The short-term coronavirus response revealed most merchants will need a more robust option for digital payments — and that’s prompting fresh investment in what was expected to be a slow period.

Without centralized IT protocols RIA cyber fraud scenarios are taking on new and nightmarish dimensions — but there are ways for firms to defend themselves.

Visa pulled its financial outlook for the rest of the year, but it already has visibility into permanent changes that result from the coronavirus — such as an aversion to handling cash.