PricewaterhouseCoopers has developed a contact-tracing app as the Big Four firm looks forward to reopening its offices during the coronavirus pandemic and tries to help its clients safely open theirs as more states announce plans to gradually lift their stay-at-home orders.

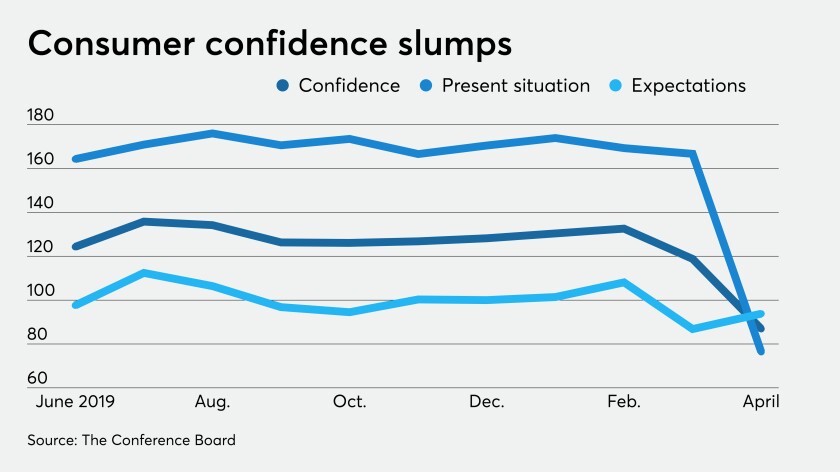

Pessimism about the economic situation in the United States continues to affect the way consumers view the economy and their financial position.

S&P Global Ratings changed its outlook on Chicago's BBB-plus rating to negative citing financial strains caused by the pandemic.

I am advising some clients to ladder maturities to lock in more dependable tax-free income streams — especially for those in states with high income taxes, like California.

With states and cities facing the worst fiscal crisis in decades, a little-noticed provision in New York’s tax law could put amicable relations with neighboring states to the test.

SOX professionals are thinking about how to revise their risk management playbook for the year in response to the pandemic.

Fintechs in the payments industry saw problems coming when the CARES Act’s SBA Paycheck Protection Program opened the floodgates for millions of coronavirus-stricken small businesses to apply for loans.

The age of coronavirus means disruption beyond what most people imagined, forcing profound changes in how we work and live.

Groups representing dealer firms and issuers both weighed in positively Monday evening after the Fed’s afternoon decision that it will expand its Municipal Liquidity Facility in both scope and duration.

Queued-up loans. Extra bankers. Government tweaks to promote fairness. None of these precautionary measures has been enough for the second round of the Paycheck Protection Program to avoid the pitfalls of the first.