Recipients of Social Security benefits, as well as railroad retirement and veterans benefits recipients, will need to act fast.

The Institute of Internal Auditors has stopped most of its in-person activities, including training, during the COVID-19 pandemic and will instead do online testing on a temporary basis for its certification exams.

Executives say they can still meet their goal of $480 million in cost savings this year from the combination of BB&T and SunTrust despite unexpected expenses, unless the economy fails to rebound quickly.

Sales taxes are a pillar of the Texas state budget, and the usually stable revenue source has taken a hit from the COVID-19 pandemic.

Mayor Eric Garcetti announced plans to furlough thousands of city employees because of coronavirus-driven shortfalls.

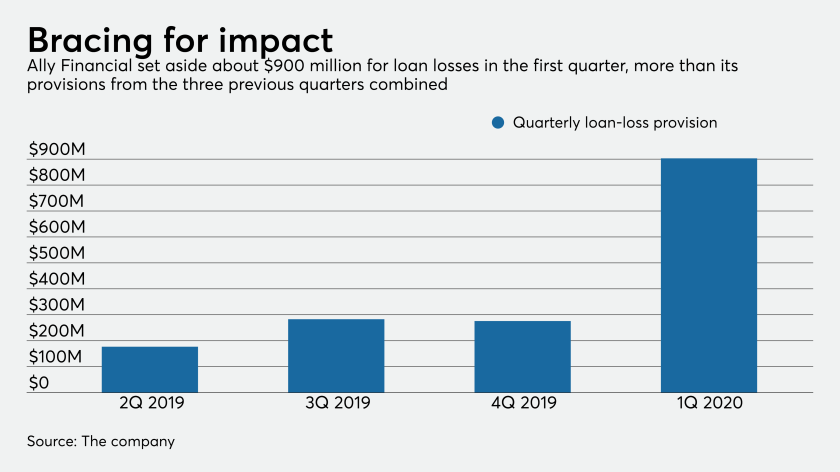

After more than tripling its loan-loss provision, the $182 billion-asset company became the first large U.S. bank to report a quarterly loss as a result of the coronavirus pandemic.

Lawmakers are considering a plan to reserve at least $50 billion in Paycheck Protection Program funds for customers of community banks and small regionals.

Two Senate Democrats are criticizing a little-known provision of the CARES Act stimulus package that would provide a tax break mostly to wealthy taxpayers, suspending excess business losses for prior tax years.

Fed officials also talk about the muni liquidity facility and efforts to help the economy in the wake of the COVID-19 pandemic.

From stimulus checks to the Paycheck Protection Program, the government’s infusion of cash into an economy reeling from the coronavirus pandemic has primarily helped those who already strong banking relationships.