The central bank said its program to support money market mutual funds will also serve as a backstop for state and local governments.

Moody’s lowered the giant IBD network’s credit rating with sobering words that could resonate across wealth management.

Moody’s affirmed the company’s “B3” rating but signalled the potential wide-reaching impact of the pandemic across wealth management.

The Money Market Mutual Fund Liquidity Facility, established under the central bank’s emergency authority, echoes a version that was set up during the global financial crisis.

The Federal Reserve's support for the commercial paper market made clear that it was willing to go beyond cutting interest rates, but the central bank may feel pressure to do even more as the crisis worsens.

Career veterans call fallout from COVID-19 concerns on the municipal market worse than that of 9/11 and the 2008 financial crisis combined.

Companies in the mortgage business were already focused on processing a lot of loans and generating efficiencies before the latest uptick in business hit.

The central bank is trying to get ahead of possible funding disruptions caused by the coronavirus. Policymakers want to avert a repeat of September, when short-term borrowing costs spiked amid imbalances in supply and demand for cash.

The San Francisco bank has revised its guidance downward, while also cautioning that an outbreak of the coronavirus could take an even bigger bite out of profits in 2020.

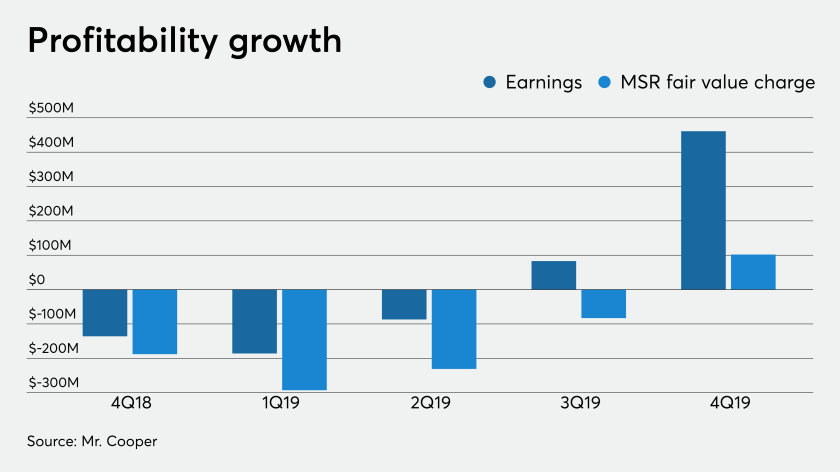

Mr. Cooper Group reported fourth-quarter net income of $461 million, aided by the recovery of its deferred tax asset and a positive mark-to-market on its servicing portfolio.