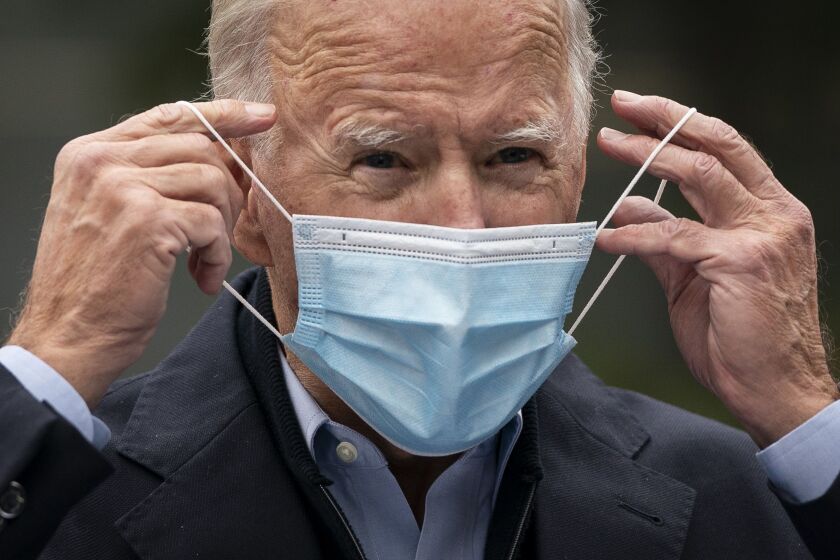

Concerns are increasing over the growing spread of COVID-19 and the preparedness of the incoming administration to deal with vaccine distribution and other critical issues.

Taxpayers around the world lose at least $427 billion each year to individual tax evasion and multinational corporate profit-shifting, which undercuts public funding for a COVID-19 response, according to a new report.

The president-elect's pledge to repeal President Donald Trump‘s tax cuts as soon as he is inaugurated may be stymied for the foreseeable future.

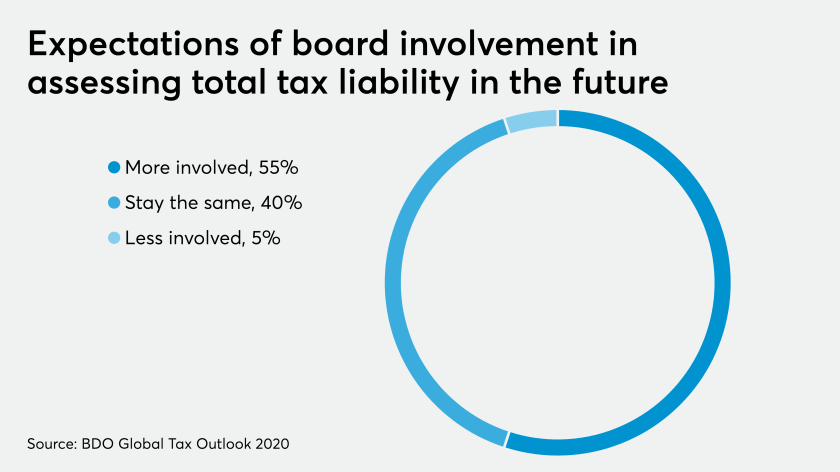

Eighty percent of the business leaders surveyed by BDO in the Americas said the focus of tax legislation changes constantly as the result of the elected party and/or it is difficult to predict.

Intercompany pricing corrections now can help generate cash by utilizing tax net operating losses.

The outcome of Tuesday’s election could be profound tax changes, but that’s only if one party wins control of both houses of Congress and the White House.

Former vice president and Democratic presidential candidate Joe Biden’s tax proposal will limit direct tax increases to just 1.9 percent of taxpayers.

This article looks at a few key components of the presidential nominees' tax positions.

Conversations have already started about how the increased government expenditures to support citizens during the pandemic will be funded. But resisting the urge to increase taxes may be the best way to support economic growth.

Companies that took advantage of federal pandemic-relief efforts like payroll tax deferrals will face bigger bills next year.