The act increased many of the limits from the Tax Cuts and Jobs Act, and the IRS has offered more guidance.

Do employees working remotely during the pandemic trigger filing obligations for their companies?

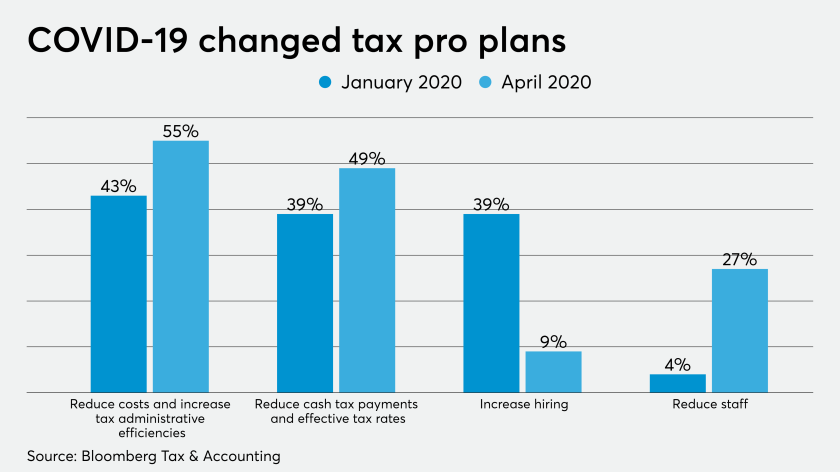

The COVID-19 pandemic is forcing corporate tax departments to reconsider their top priorities for this year, according to a new survey.

Lax eligibility requirements are raising new questions about which firms should get access to public money.

There's a great deal of help for businesses in the CARES Act and the FFCRA.

In a down economy, international planning is even more important.

The Internal Revenue Service posted a set of questions and answers Monday to help companies claim net operating losses and tax credits for prior years so they can get faster tax refunds in the midst of the novel coronavirus pandemic.

Richard Branson moved assets from the U.S. to the British Virgin Islands, highlighting his use of tax havens at a time one of his businesses sought a state bailout because of the coronavirus pandemic.

The measure contains tax relief for both businesses and individuals, and other stimulus measures.

Large retailers like Walmart Inc. and Target Corp., as well as student loan borrowers, are on a long list of potential winners from tax breaks included in a $2 trillion coronavirus relief bill approved by the Senate.