- 3 Min Read

Discover is working to help Black-owned businesses and other merchants maintain foot traffic — safely — through the use of the card network's payments technology and its marketing heft.

1 Min ReadThe COVID-19 pandemic has teed up a growth opportunity for the buy now, pay later (BNPL) financial industry, as recession worries made people receptive to entering short-term payment plans that can fit in a budget.

3 Min ReadThe six largest credit card issuers have set aside billions of dollars worth of reserves in response to the novel coronavirus as well as the adoption of the Financial Accounting Standards Board’s new credit losses standard.

5 Min ReadThe major card networks have heavily invested in broader services as transaction processing loses its luster, a strategy that’s provided a ray of hope as retail and travel industries remain sidelined.

2 Min ReadThis personal funding has blurred the line between personal and business finances more than ever.

1 Min ReadCash usage dropped much lower due to the coronavirus pandemic, and it appears that credit cards may be exhibiting some signs of abandonment as well.

3 Min ReadMastercard reported a sharp decline in payments in its most recent quarter, but some digital seeds it planted before the coronavirus pandemic are already bearing fruit.

4 Min ReadThe coronavirus outbreak has caused economic activity to crater, and Visa says its focus on services, partnerships and e-commerce has provided stability and a route to growth.

3 Min ReadThree months ago, Stephen Squeri, the chairman and CEO of American Express, declared a global "economic free fall" due to the coronavirus. Its second-quarter earnings show how far a fall it has been.

5 Min ReadWith the COVID-19 health pandemic wreaking havoc on jobs, investments, consumer debt and lending, secured credit cards can address a vital need for people who may not have considered the product in the past.

3 Min ReadThe race to provide coronavirus relief for small businesses is opening new routes to fund payments, including underused credit lines.

1 Min ReadUnlike past economic recessions where businesses and consumers have had to adjust their payment habits and debt levels over the course of months or quarters as the economy shrank, the coronavirus-induced economic crisis has forced many to make much more abrupt financial adjustments.

4 Min ReadU.S. card issuers aren’t getting the full benefit of the contactless phenomenon because of their slower contactless card rollout strategies.

3 Min ReadOne of the selling points behind multi-account payment cards is the ability to shift spending on the fly or shortly after shopping, such as to fund a recent purchase with loyalty points. During the pandemic, this feature may become a key financial management tool.

1 Min ReadVisa is delaying previously announced interchange and fee changes until April 2021, except for changes in the supermarket category, which will remain on the same schedule.

1 Min ReadCredit inquiries for auto lending, revolving credit cards and mortgages fell sharply in March as unemployment surged, according to a Consumer Financial Protection Bureau report.

3 Min ReadVisa pulled its financial outlook for the rest of the year, but it already has visibility into permanent changes that result from the coronavirus — such as an aversion to handling cash.

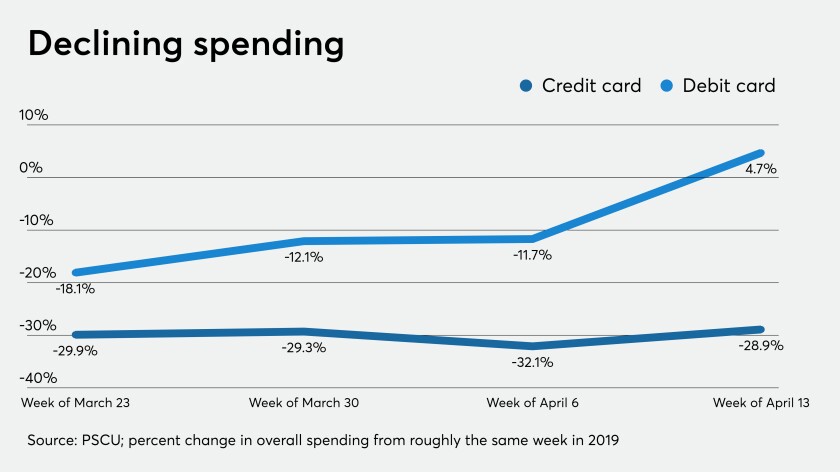

5 Min ReadConsumers are using their debit and credit cards less, and that's causing a decline in interchange income for credit unions and banks.

4 Min ReadThere is nothing in U.S. federal laws or general payment processes that stops businesses from taking a consumer's money and using it for payroll or to finance a marketing campaign.

2 Min ReadFears of catching coronavirus during the payment process has given a sharp boost in usage and awareness of contactless payments since the pandemic began, according to a new survey from Mastercard.