- 3 Min Read

The race to provide coronavirus relief for small businesses is opening new routes to fund payments, including underused credit lines.

1 Min ReadUnlike past economic recessions where businesses and consumers have had to adjust their payment habits and debt levels over the course of months or quarters as the economy shrank, the coronavirus-induced economic crisis has forced many to make much more abrupt financial adjustments.

4 Min ReadU.S. card issuers aren’t getting the full benefit of the contactless phenomenon because of their slower contactless card rollout strategies.

3 Min ReadOne of the selling points behind multi-account payment cards is the ability to shift spending on the fly or shortly after shopping, such as to fund a recent purchase with loyalty points. During the pandemic, this feature may become a key financial management tool.

1 Min ReadVisa is delaying previously announced interchange and fee changes until April 2021, except for changes in the supermarket category, which will remain on the same schedule.

1 Min ReadCredit inquiries for auto lending, revolving credit cards and mortgages fell sharply in March as unemployment surged, according to a Consumer Financial Protection Bureau report.

3 Min ReadVisa pulled its financial outlook for the rest of the year, but it already has visibility into permanent changes that result from the coronavirus — such as an aversion to handling cash.

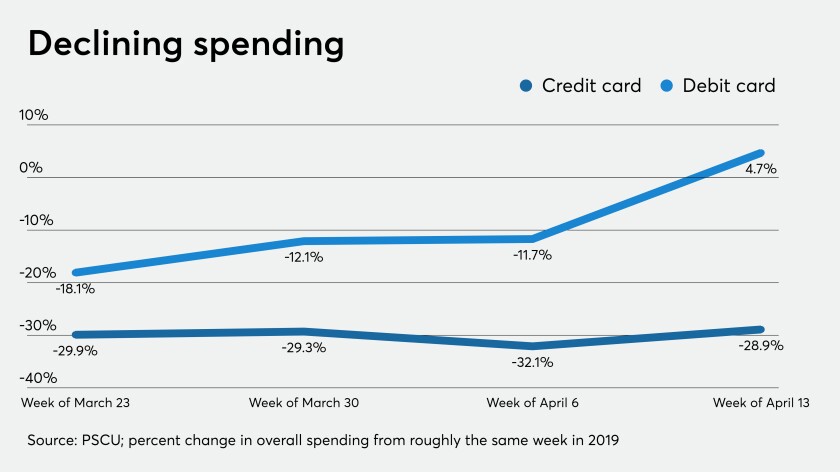

5 Min ReadConsumers are using their debit and credit cards less, and that's causing a decline in interchange income for credit unions and banks.

4 Min ReadThere is nothing in U.S. federal laws or general payment processes that stops businesses from taking a consumer's money and using it for payroll or to finance a marketing campaign.

2 Min ReadFears of catching coronavirus during the payment process has given a sharp boost in usage and awareness of contactless payments since the pandemic began, according to a new survey from Mastercard.

4 Min ReadMastercard CEO Ajay Banga says he is certain that science, medicine and innovation will lead the world out of the coronavirus pandemic, but there is little indication of when that will happen.

5 Min Read"We're now in a different world," Stephen Squeri, chairman and CEO of Amex, said during the card brand's first-quarter earnings call.

3 Min ReadDiscover and Sallie Mae are the latest to report a surge in forbearance requests as households struggle with job loss and other hardships resulting from the coronavirus pandemic.

3 Min ReadDiscover transitioned all of its 8,000 U.S.-based call center personnel to work from home within a matter of days after the U.S. declared a national emergency on March 13. By March 20, Discover had 95% of its agents working from home using a thin-client device to emulate their call center desktops.

3 Min ReadWith coronavirus driving more merchants to promote electronic payments over cash — and contactless payments over cards — many are still asking their customers to share a potentially virus-laden pen to sign a receipt or screen at the point of sale.

7 Min ReadThe agency has relaxed some reporting requirements and joined other regulators in encouraging banks to help borrowers, but pressure is building on the bureau to do more to aid consumers suffering financial hardship.

2 Min ReadThe reprieve from mortgage data collection was among several changes to the agency’s supervisory and enforcement procedures to help firms responding to the COVID-19 pandemic.

3 Min ReadAlliance Data Systems, which has substantial exposure to the mall-based retail sector, sought Tuesday to assuage investors' fears about the impact of the COVID-19 outbreak.

5 Min ReadCobranded travel credit cards — including some of the most popular and profitable in the payment card industry — are looking at darker skies because of COVID-19.

2 Min ReadAs India’s first billion-dollar share sale in more than two years and the only credit card firm in the nation to go public, SBI Cards and Payment Services Ltd.’s float may exceed the $1.4 billion target. The question is by how much in the face of the coronavirus outbreak.