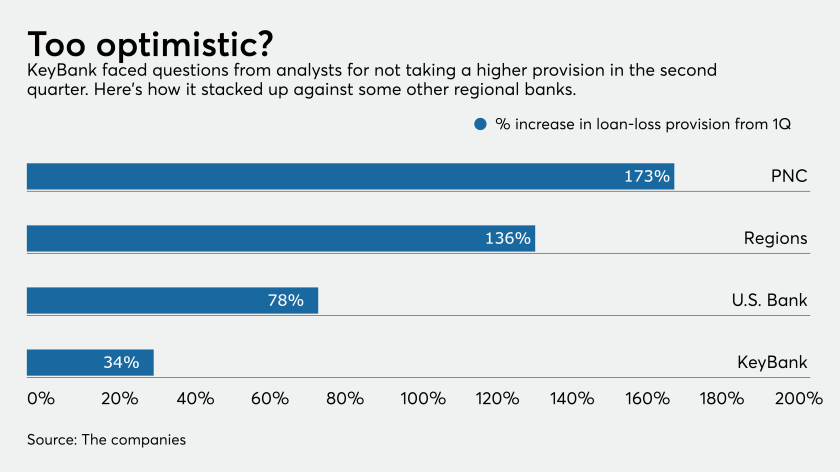

Other regionals set more aside for loan losses than the Cleveland bank did in the second quarter, and its ratio of reserves to total loans is slightly lower, too. But Key executives say the portfolio is balanced and holding up well despite the pandemic’s economic toll.

Two years ago, the Tulsa, Okla., company expanded its Native American casino lending business nationwide. It seemed like a great plan until the coronavirus pandemic struck.

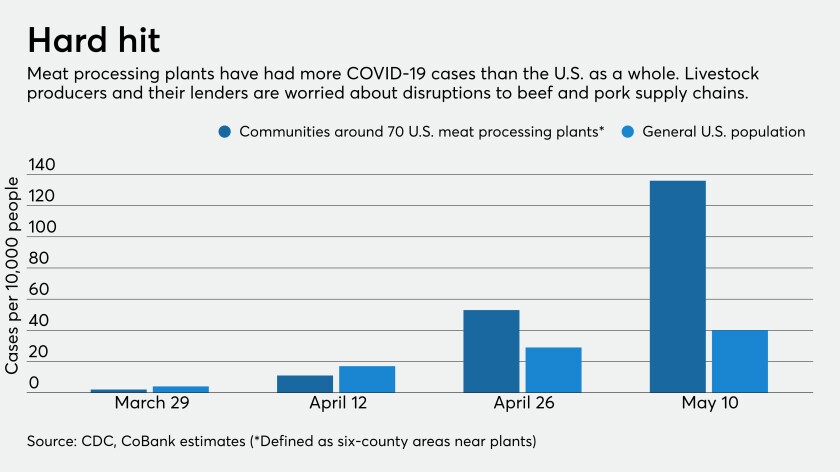

Lenders are scrambling to pause ranchers’ loan payments as meat processing plant shutdowns during the pandemic threaten $25 billion in losses for the livestock industry.

The Pittsburgh company’s sale of its stake in the asset manager yielded billions of dollars that could cushion the pandemic’s economic blow and eventually help fund a big acquisition.

Elected officials are better off deciding who’s most deserving of federally backed coronavirus relief funds for small businesses.

More details have emerged about the damage the coronavirus pandemic is inflicting on the hospitality industry. One servicer alone has received 2,000 workout requests in the past month.

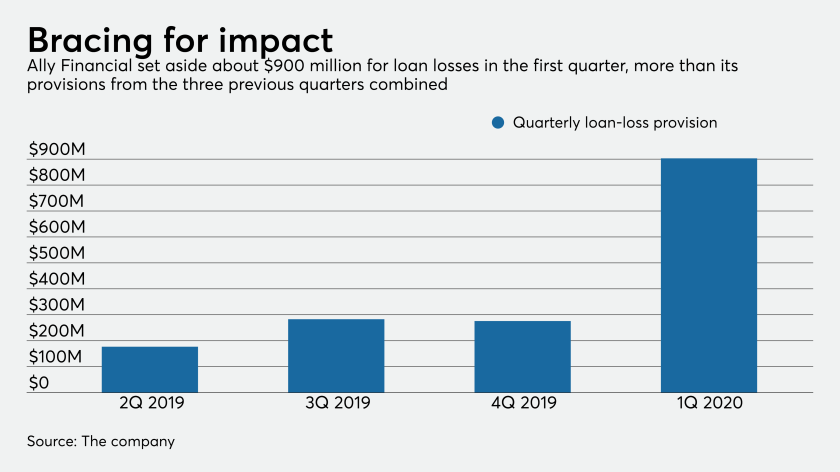

After more than tripling its loan-loss provision, the $182 billion-asset company became the first large U.S. bank to report a quarterly loss as a result of the coronavirus pandemic.

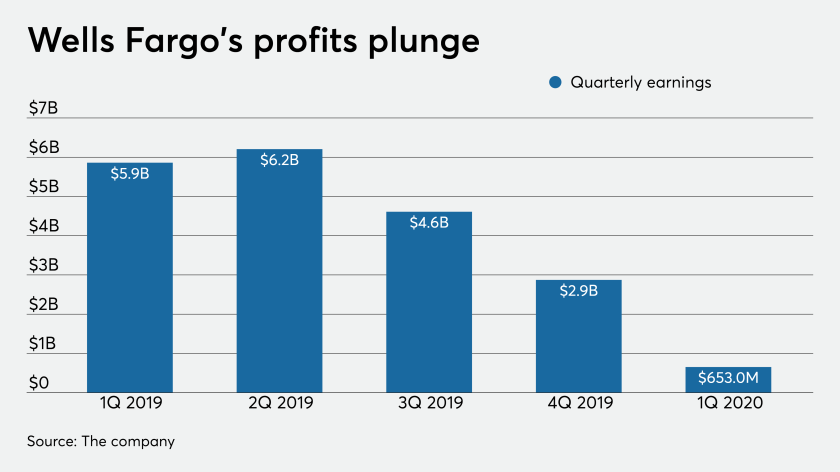

Its prediction that business conditions will remain weak this year — and into next year — stands in stark contrast to forecasts from political leaders that the economy will rebound quickly from the coronavirus pandemic.

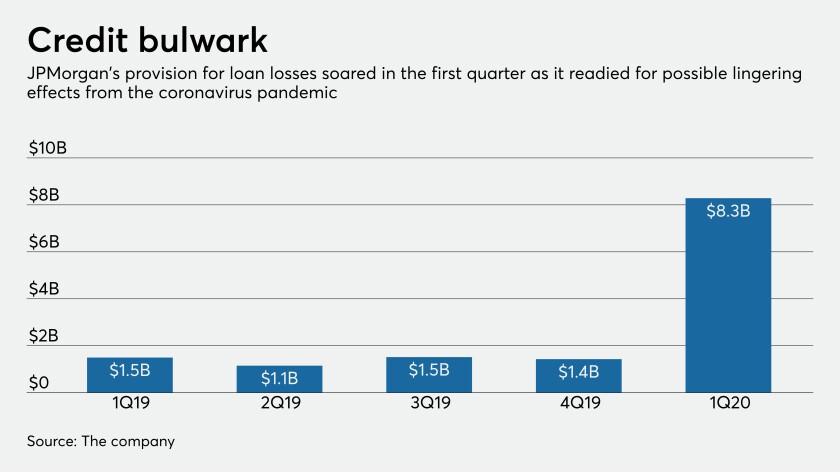

Though hopeful for a second-half bounceback in the economy, JPMorgan Chase is prepared for 20% unemployment, lackluster GDP and losses in its loan portfolio that could reach tens of billions of dollars.

By helping borrowers now, banks hope customers can quickly catch up on payments once the coronavirus pandemic ends. If they can’t, interest income will remain low and charge-offs could pile up if the crisis drags on.