More than a third fear the fallout from the coronavirus pandemic could drag into 2022 or later, and they are most worried about commercial real estate loans, according to a Promontory Interfinancial Network survey.

Current economic conditions will have "a continued adverse effect on our businesses” if they persist or worsen, Bank of America warns.

Cash usage dropped much lower due to the coronavirus pandemic, and it appears that credit cards may be exhibiting some signs of abandonment as well.

CEO Greg Carmichael says the Cincinnati company has cut expenses but will proceed with branch openings in the Southeast and investments in its commercial loan and mortgage origination platforms to lay the groundwork for post-pandemic growth.

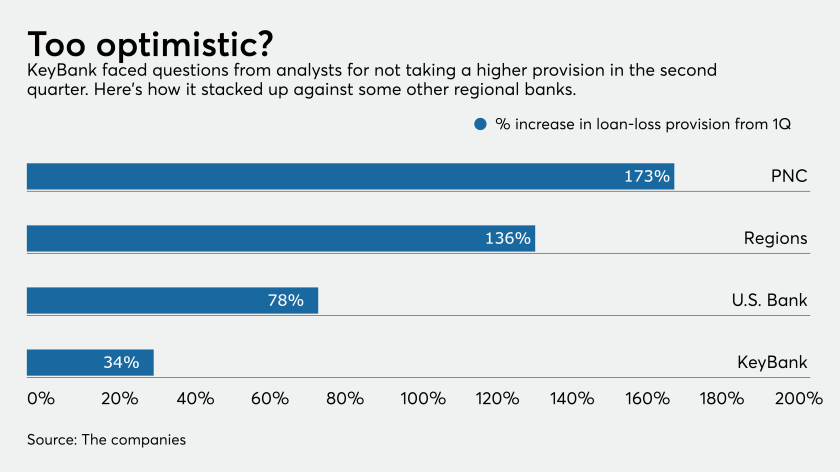

Other regionals set more aside for loan losses than the Cleveland bank did in the second quarter, and its ratio of reserves to total loans is slightly lower, too. But Key executives say the portfolio is balanced and holding up well despite the pandemic’s economic toll.

The race to provide coronavirus relief for small businesses is opening new routes to fund payments, including underused credit lines.

Two years ago, the Tulsa, Okla., company expanded its Native American casino lending business nationwide. It seemed like a great plan until the coronavirus pandemic struck.

Unlike past economic recessions where businesses and consumers have had to adjust their payment habits and debt levels over the course of months or quarters as the economy shrank, the coronavirus-induced economic crisis has forced many to make much more abrupt financial adjustments.

Comptroller of the Currency Joseph Otting says the revised Community Reinvestment Act will provide more credit access to communities in need and won't, as some had feared, create new thresholds for grading banks.

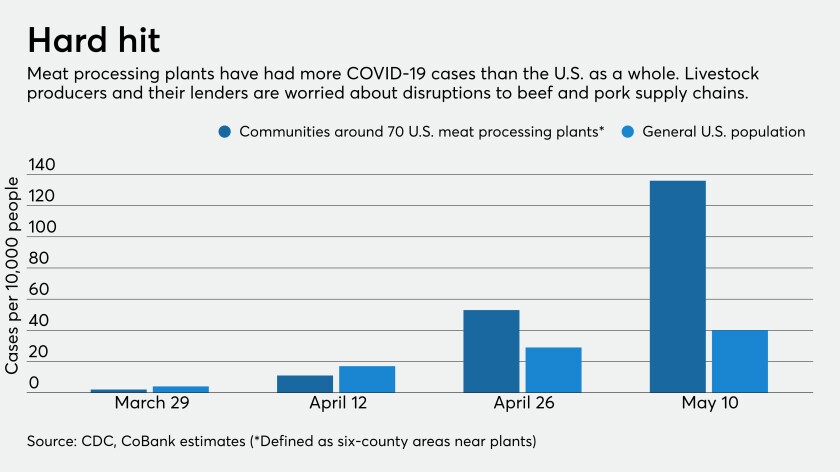

Lenders are scrambling to pause ranchers’ loan payments as meat processing plant shutdowns during the pandemic threaten $25 billion in losses for the livestock industry.