If Capitol Hill plans another round of stimulus, Democrats could have more leverage to demand steps such as suspending overdraft fees or placing a temporary cap on consumer lending rates.

The agency said lenders should avoid reporting delinquent payments to credit bureaus for consumers who have sought payment relief due to the pandemic.

Alliance Data Systems, which has substantial exposure to the mall-based retail sector, sought Tuesday to assuage investors' fears about the impact of the COVID-19 outbreak.

Bankers will be pressed on upcoming earnings calls to forecast how the coronavirus pandemic — and the government's response — will shape credit quality, margins and fee income.

Congressional Democrats want forceful action to prevent damage to millions of Americans' credit scores during the COVID-19 pandemic. But the credit bureaus argue that the tools needed to protect consumers are already in place.

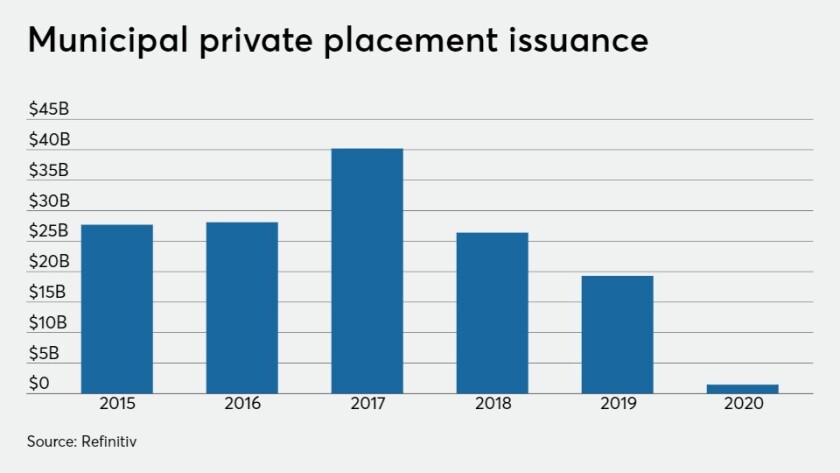

A big New York State Empire Development Corp. private placement is likely to be followed by more until the municipal primary starts functioning again.

The Federal Reserve committed Monday to conducting more asset purchases of Treasury securities and mortgage-backed securities and announced $300 billion in new financing for credit facilities.

As financial hardships mount with the COVID-19 outbreak, Fannie Mae and Freddie Mac released their plans for mortgage borrowers impacted by the pandemic.