The coronavirus is changing how consumers interact in branches and banking online. Bank leaders should be prepared.

A recent webcast urged businesses to focus on potential upsides and customer/employee engagement amid the coronavirus outbreak.

The Fed must set up a "family financial facility" that sends billions to households and small businesses so banks don’t misdirect relief funds.

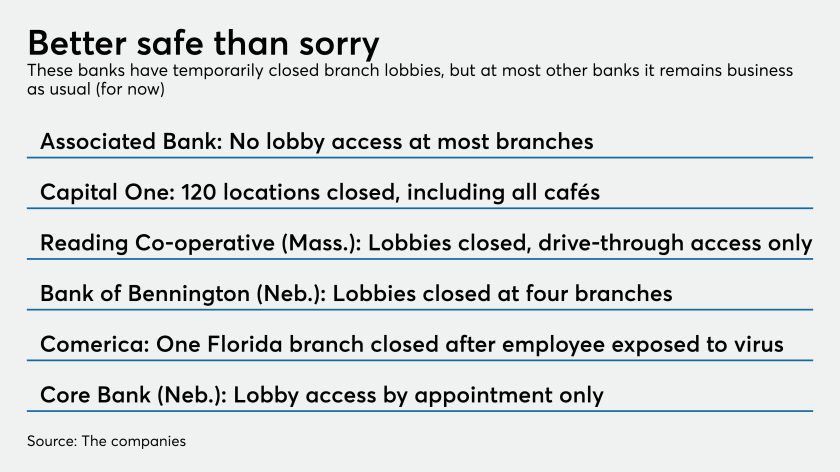

Institutions across the country are restricting entrance to their facilities to help curb the spread of COVID-19 but profitability issues could crop up if the pandemic drags on.

The Money Market Mutual Fund Liquidity Facility, established under the central bank’s emergency authority, echoes a version that was set up during the global financial crisis.

Customers are increasingly concerned about taking a financial hit from the COVID-19 crisis and want to know more about fee waivers, credit-line increases and other things banks could do for them.

There are several forbearance measures the agencies can take now to keep banks from failing in a downturn triggered by the coronavirus.

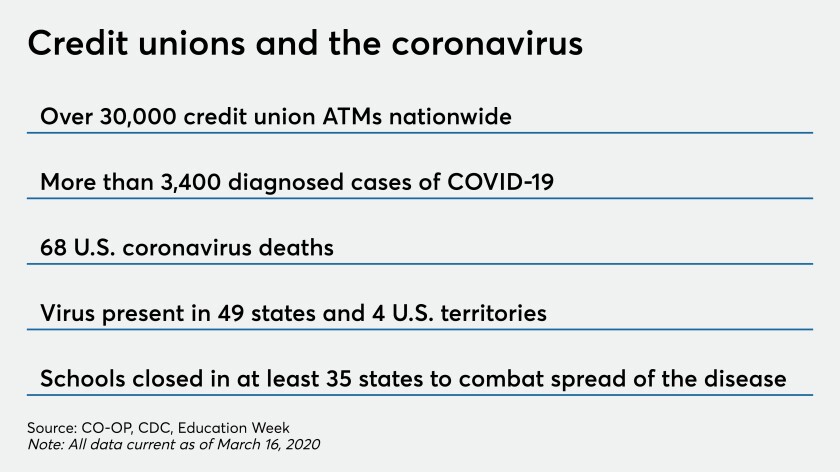

Automated and interactive teller machines aren’t germ-free in the best of times, and the pandemic has raised new concerns about the possibility of those devices infecting consumers and staff.

Many institutions said they would close branches, operate drive-throughs only, limit lobby visits to appointments or take other protective steps. Yet others want to stay open to promote public confidence in the banking system.

The actions include cutting the federal funds rate to between 0% and 0.25% and other steps to ease economic stress from the spread of the coronavirus.