With consumers and merchants alike sharing the need to be paid faster, the case for adopting real-time payments globally has quickly advanced during the COVID-19 pandemic.

Western Union confirmed yet again that for a payments company to survive the coronavirus pandemic, it needed to enter the crisis with a strong footing in digital payments.

MoneyGram International's digital transformation came at just the right time, considering walk-in traffic at MoneyGram locations in certain regions of the world was stymied for months by the coronavirus pandemic. But for many people, digital is still no replacement for the human touch.

Universities are facing the same uncertainties as any other business during the coronavirus pandemic. This is especially true for universities that cater to international students.

The growth in remittance providers' digital customer sign-ups accelerated as the U.S. went into a nationwide lockdown in the middle of March, and has continued through the summer despite store reopenings that could pull customers back to their old habits of paying in person.

The coronavirus pandemic has made paper money literally a dirty word, causing a rush to digital payments that may be too fast for Western Union and MoneyGram to keep up with as separate companies.

Consumer remittance behaviors are being forced to change, with senders and recipients moving to mobile wallets, bank accounts, and cards. But many still want cash.

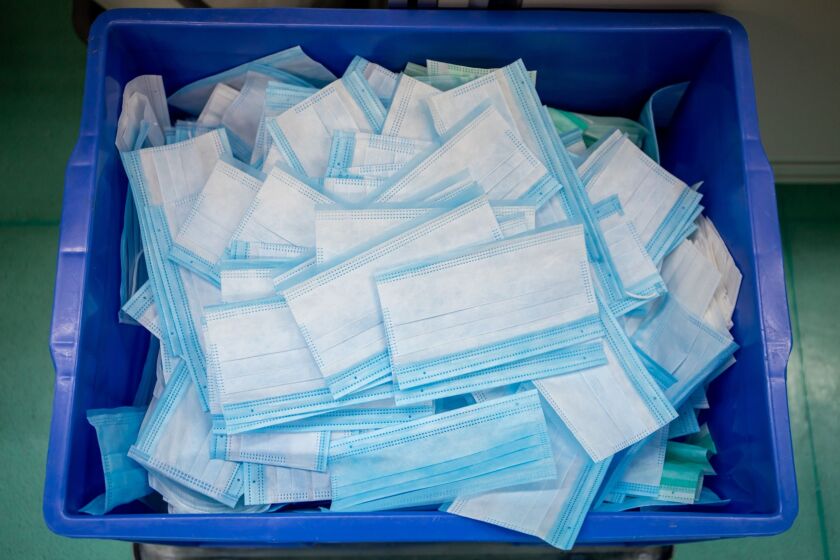

The shortage of personal protective equipment (PPE) for medical workers is one of the most troublesome elements of the coronavirus outbreak, though prior work to declutter cross-border supply chain payments provides some hope.

Amid the worldwide coronavirus crisis, making cross-border payments to emerging markets has been akin to putting together a jigsaw puzzle without many of its pieces.

Canada’s small businesses have lagged behind the U.S. in adopting digital commerce for a variety of reasons, but coronavirus might send things in a new direction.