As more consumers do business online, some deposits are being unfairly categorized as brokered, inviting burdensome regulatory scrutiny.

The Office of the Comptroller of the Currency will use year-end 2019 asset totals in its calculating its next assessment, saying national banks "should not be penalized" for adding emergency loans to their books during the pandemic.

Even after the Fed eased some limitations in April to promote emergency lending, the bank has had to make some “tough choices” to heed the $1.95 trillion growth ceiling set by regulators in the aftermath of its phony-accounts scandal.

The central bank said customers will be able to make more transfers and withdrawals "at a time when financial events associated with the coronavirus pandemic have made such access more urgent."

Consumers and businesses put more money in the bank as the pandemic worsened. How long the funds remain will depend on how quickly the economy recovers.

The agency proposed changes in December to how customer relationships affect the definition of brokered funds, which has big implications for banks that are not well capitalized.

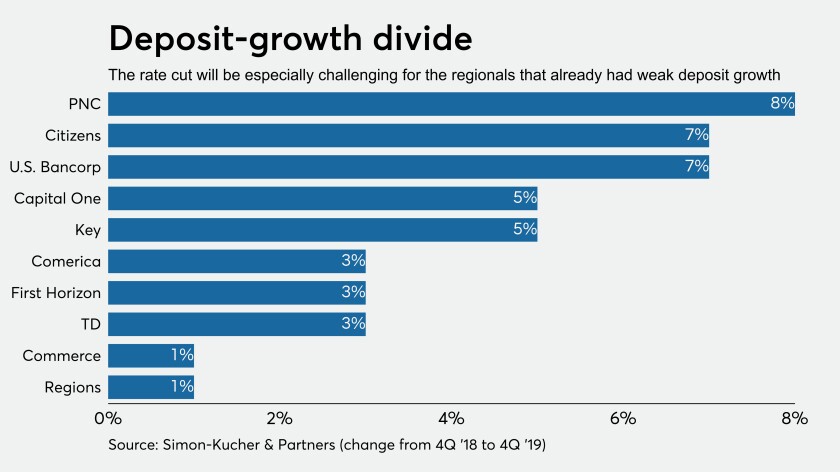

The Fed’s decision to cut its benchmark interest rate amid growing coronavirus concerns is bound to have an impact on banks, but just how broad and how deep remains to be seen.