- 5 Min Read

If the mega payments deals of 2019 left the acquiring landscape somewhat scorched, the COVID-19 pandemic planted new seeds to allow ISOs to grow by quickly converting merchants to electronic payments.

5 Min Read"It's on-demand capital for us," Optus Bank's CEO says of the payment company's deposit. The funds are part of PayPal's broader effort to confront race and income inequality.

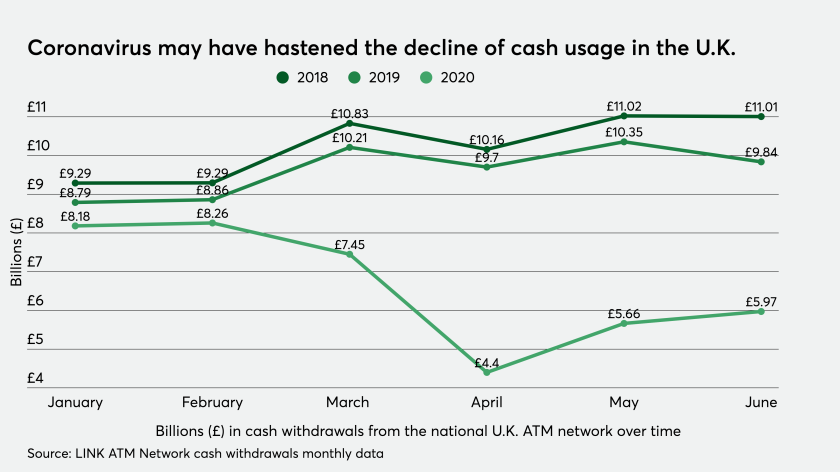

3 Min ReadVarious efforts to limit cash were in motion well before the global health crisis, but merchant and consumer digital money habits being built during the pandemic will carry on for many years, thus leaving cash sidelined in many purchasing scenarios.

5 Min ReadAmid the economic and health wreckage the COVID-19 global pandemic has created, payments have stepped to the forefront in a way that has allowed banks, merchants and consumers to not only continue to do business, but also to increase communication.

1 Min ReadThe COVID-19 pandemic has teed up a growth opportunity for the buy now, pay later (BNPL) financial industry, as recession worries made people receptive to entering short-term payment plans that can fit in a budget.

3 Min Read7-Eleven’s not a quick serve restaurant chain or an e-commerce marketplace, but it still found substantial use for its app as a way to quickly address the health worries of its customers.

4 Min ReadThe coronavirus outbreak initially looked like it might torpedo U.K.-based Paysafe’s plan to expand in the U.S. in 2020. But several months into the pandemic, the payments conglomerate sees ways it can grow by helping bruised small businesses retool operations.

4 Min ReadSquare's gross payment volume tumbled by 15% year-over-year due to COVID-19’s impact, but revenue jumped as online selling rose, Cash App doubled in users and Square enabled almost $900 million in PPP loans.

5 Min ReadThe point of sale terminal industry was already under pressure to go digital before the coronavirus pandemic made this transition much more crucial to its survival.

3 Min ReadWestern Union confirmed yet again that for a payments company to survive the coronavirus pandemic, it needed to enter the crisis with a strong footing in digital payments.

3 Min ReadPayment processor Elavon purchased Sage Pay four months ago, completing the acquisition on March 11. Two days later, Elavon's entire workforce was operating remotely as the coronavirus forced it into lockdown.

5 Min ReadThe major card networks have heavily invested in broader services as transaction processing loses its luster, a strategy that’s provided a ray of hope as retail and travel industries remain sidelined.

3 Min ReadMoneyGram International's digital transformation came at just the right time, considering walk-in traffic at MoneyGram locations in certain regions of the world was stymied for months by the coronavirus pandemic. But for many people, digital is still no replacement for the human touch.

3 Min ReadMastercard reported a sharp decline in payments in its most recent quarter, but some digital seeds it planted before the coronavirus pandemic are already bearing fruit.

4 Min ReadThe company's results put firm numbers on one of the most discussed business trends of the pandemic economy — the acceleration of digital payments.

4 Min ReadThe coronavirus outbreak has caused economic activity to crater, and Visa says its focus on services, partnerships and e-commerce has provided stability and a route to growth.

4 Min ReadRepublicans and Democrats are negotiating a new coronavirus stimulus package, but there’s still no law on the books designed to erase the problems that prevented many stimulus payments from getting directly to recipients.

4 Min ReadCheckout-free stores still feel experimental, but the coronavirus pandemic is pushing more retailers to contemplate how to reduce human interaction in larger settings.

4 Min ReadUniversities are facing the same uncertainties as any other business during the coronavirus pandemic. This is especially true for universities that cater to international students.

1 Min ReadThe coronavirus pandemic has cast a shadow over the use of cash, which is often perceived as dirty because it frequently changes hands and is almost never washed.