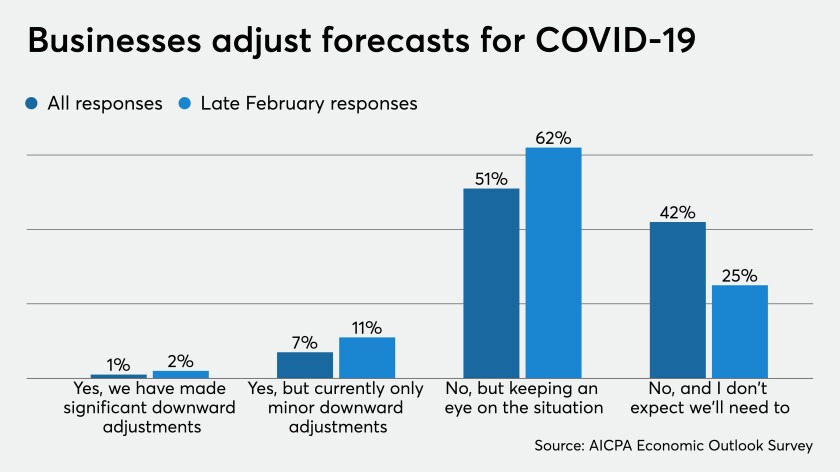

With economic uncertainty, a pandemic, and concerns around race and equity topping daily headlines, existing initiatives to transform and innovate across people, processes and technology have become more amplified.

The COVID-19 pandemic has highlighted the need to have a business continuity and disaster recovery plan and a pandemic plan in place.

2020 is testing the profession’s resiliency like nothing has before, and accountants are losing sleep, skipping vacations, and working longer hours to adapt to the challenges COVID-19 has brought.

Coronavirus has taken bankers out of their comfort zone. But they should view adaptations they’ve made in confronting the pandemic as a chance to hone their emergency response skills, not a permanent new normal.

Reports from the Singapore office, a coronavirus war room and a hardworking IT staff all helped TD Bank Group get nearly all employees ready to work from home and able to handle a tripling of remote deposit capture activity.

The passage extends the IRA contribution deadline and waives RMDs for 2020. Here’s what else financial advisors need to know.

High Rock Accounting provides clients with cash flow assistance and guidance. But what happens when a firm needs the same assistance?

We've had many chances to learn, from the dot-com bust to the 2008 financial crisis. But the storm is perhaps most applicable to our current situation.

As a longtime proponent of flat fees, I see a lot of pain ahead for firms that rely solely on assets under management.

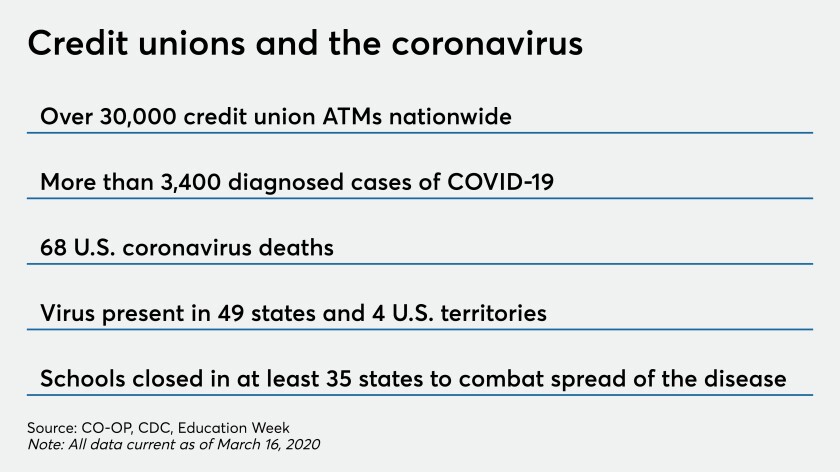

Automated and interactive teller machines aren’t germ-free in the best of times, and the pandemic has raised new concerns about the possibility of those devices infecting consumers and staff.