With economic uncertainty, a pandemic, and concerns around race and equity topping daily headlines, existing initiatives to transform and innovate across people, processes and technology have become more amplified.

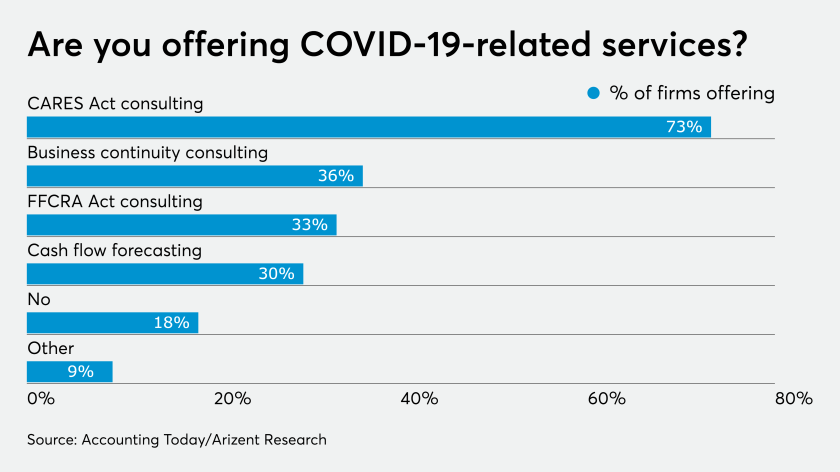

The COVID-19 pandemic has highlighted the need to have a business continuity and disaster recovery plan and a pandemic plan in place.

James Smith, who recently completed his gradual transition out of banking, was spearheading a public-private economic development plan for Connecticut when the coronavirus pandemic hit. The crisis made the need for the plan greater — and the job harder.

Employment growth at small businesses improved slightly in May, up 0.25 percent, as stay-at-home orders eased in most states, but that was only after reaching historic lows in April, according to payroll giant Paychex.

But relatively few audit execs are actually performing reviews of critical risk areas such as health and safety.

Many will reconfigure what they do to the new reality and will make some investments in updating and formalizing some of their Band-Aid processes.

A lack of modern lease accounting capabilities makes it difficult for many businesses with large lease portfolios to regain control, improve liquidity and plan for the future.

Employees are worried about whether they can return to work safely.

Despite this unprecedented crisis, organizations are responding with determination, purpose and compassion.

Coronavirus has taken bankers out of their comfort zone. But they should view adaptations they’ve made in confronting the pandemic as a chance to hone their emergency response skills, not a permanent new normal.