The Internal Revenue Service is extending until June 30, 2021 the period in which it will accept digitally signed and emailed documents due to the COVID-19 pandemic.

The Internal Revenue Service added six more forms to the 10 that support e-signatures.

The Internal Revenue Service is temporarily allowing the use of digital e-signatures on some forms that can’t be filed electronically.

Small businesses have run into roadblocks trying to apply for PPP loans since the pandemic triggered mandatory closures.

The Internal Revenue Service is giving retirement plan participants and beneficiaries some added flexibility during the COVID-19 pandemic to remotely sign or have their retirement plan elections notarized.

The Internal Revenue Service is now accepting email and digital signatures on tax documents to make it easier for tax professionals and taxpayers to communicate with the agency during the novel coronavirus pandemic.

As the world practices social distancing to counteract spreading the virus further, it forces lenders to move as close as possible to an all-digital model, as quickly as possible.

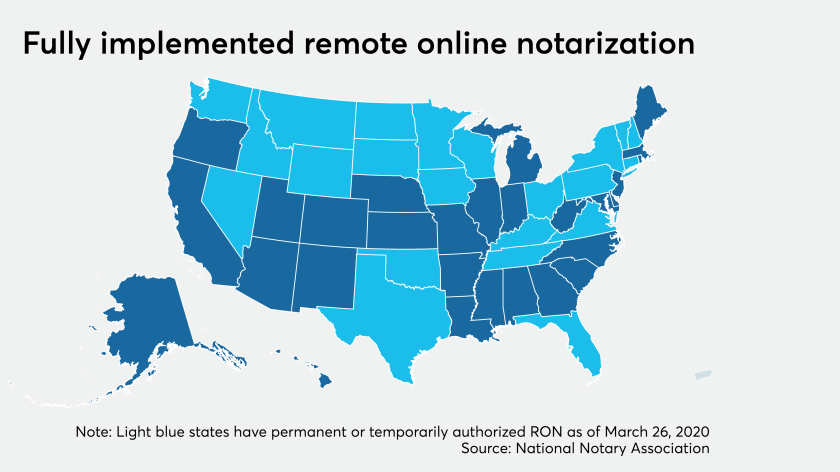

Electronic closings are a solution in efforts to limit people congregating, but there could be some state law concerns.