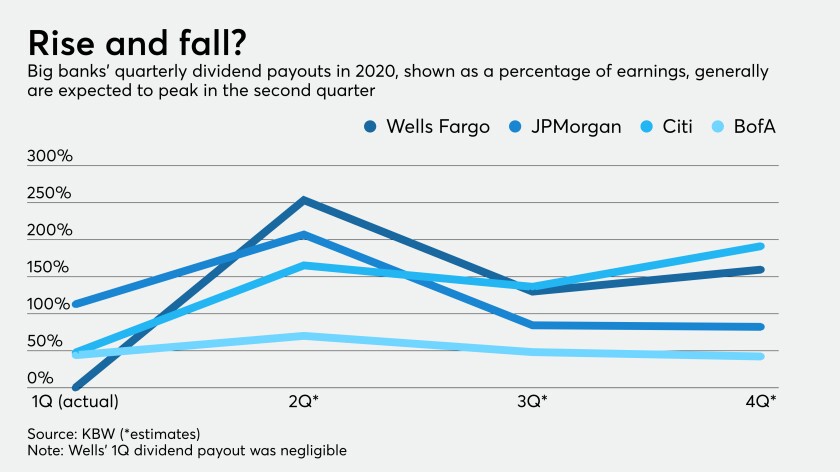

Payouts continue to be relatively generous, but that could change if the Federal Reserve demands banks bolster capital or the economy worsens.

In response to the coronavirus, the Internal Revenue Service and the Treasury are giving renewable energy companies more time to develop projects using sources such as wind and geothermal.

The SBA’s form clarifies some issues, but still leaves questions to be answered.

Tosha Anderson of The Charity CFO shares the strategies that not-for-profit organizations are taking to weather COVID-19.

Bankers have become more uncertain about how to serve marijuana businesses owing to confusion about which states deem them essential.

Demand has soared for mental health services as bank employees put in long hours, supervise kids while working at home and endure personal crises. Citi, BofA, Fifth Third and others are getting creative to help them decompress during the pandemic.

Business operations need cash influxes now more than ever.

Jennifer Roberts, the company's head of business banking, details a process to have units work one-on-one with customers to get Paycheck Protection Program funds deployed faster.

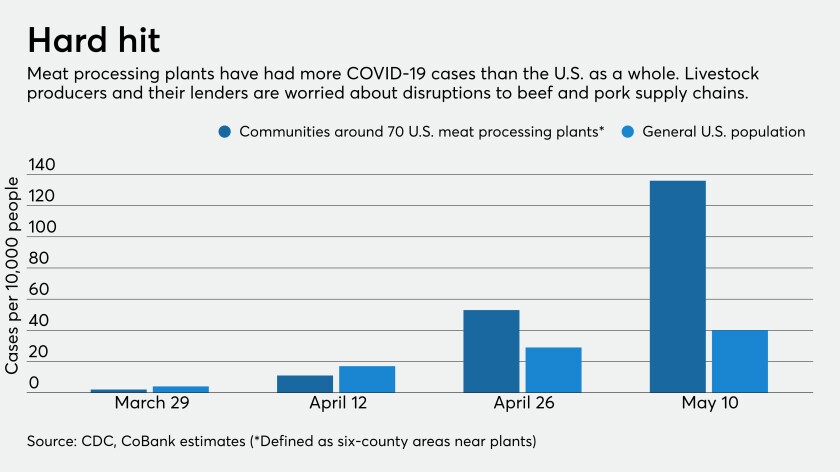

Lenders are scrambling to pause ranchers’ loan payments as meat processing plant shutdowns during the pandemic threaten $25 billion in losses for the livestock industry.

Saul Van Beurden's team is tasked with keeping systems running during the pandemic, including driving equipment to homebound workers. Yet the bank must continue making upgrades demanded by regulators, investing in new technology and recruiting top talent, he says.