The American Institute of CPAs offered suggestions on how the federal government’s Paycheck Protection Program should deal with forgiving loans.

Elected officials are better off deciding who’s most deserving of federally backed coronavirus relief funds for small businesses.

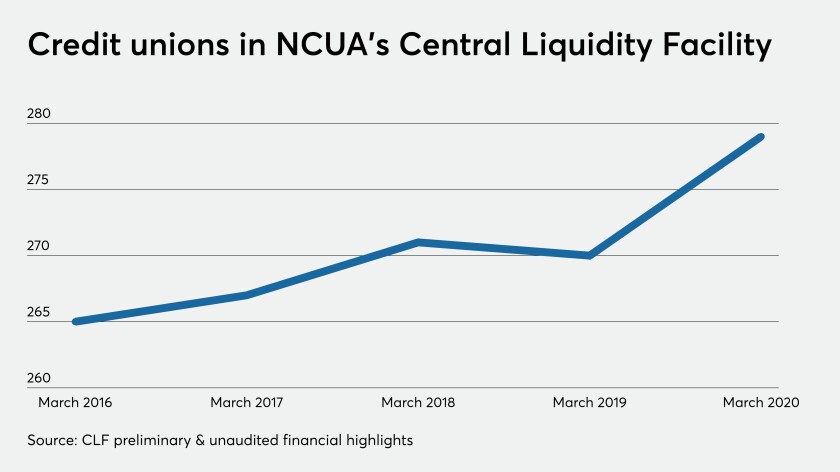

A credit union-specific liquidity backstop is far less popular than other options such as the Federal Reserve's discount window. The National Credit Union Administration wants to change that.

Payroll giant Paychex is partnering with Biz2Credit, Fundera and Lendio to help small businesses apply for the new funding offered by the U.S. Small Business Administration’s Paycheck Protection Program.

Treasury Secretary Steven Mnuchin says the additional funding Congress approved Thursday to help small businesses survive the coronavirus pandemic should be the last round, but advocates fear it’ll run out quickly and won’t be enough for mom-and-pop shops struggling to stay open.

The policy move will allow small institutions participating in the Paycheck Protection Program to pledge business loans as collateral to obtain advances.

Lawmakers should approve a program to distribute stimulus funds using a government-sanctioned coin, which would be speedier than the current system.

The March losses underscore the fiscal strains for hospitals but many facilities are expected soon to resume elective surgeries and diagnostic procedures.

The new federal COVID-19 relief package probably won’t be the last boost the U.S. economy will get, economists say.

The new bill to replenish the Paycheck Protection Program clarifies that hospitals created as political subdivisions are eligible.