The Bradenton-Sarasota, Fla., area has been a red-hot housing market with the median price at or above $300,000 for the past year, providing job opportunities for 7,000 real estate agents.

With a significant decline in new infections in China, positive news may be ahead, one expert says.

It’s another action taken by wealth management firms to safeguard employees and clients from the coronavirus.

Mortgage applications to purchase new homes took a small step back in February from record levels during the previous month, but further positive momentum could be blunted by the coronavirus.

Hotels and restaurants are losing as much as 50% of their business in the District of Columbia due to the coronavirus.

There are several forbearance measures the agencies can take now to keep banks from failing in a downturn triggered by the coronavirus.

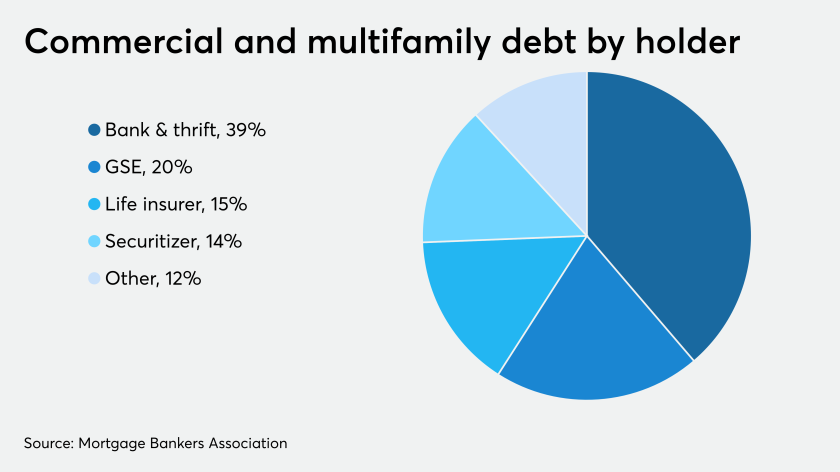

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

Advisors may find it difficult to connect with the people who need financial help the most.

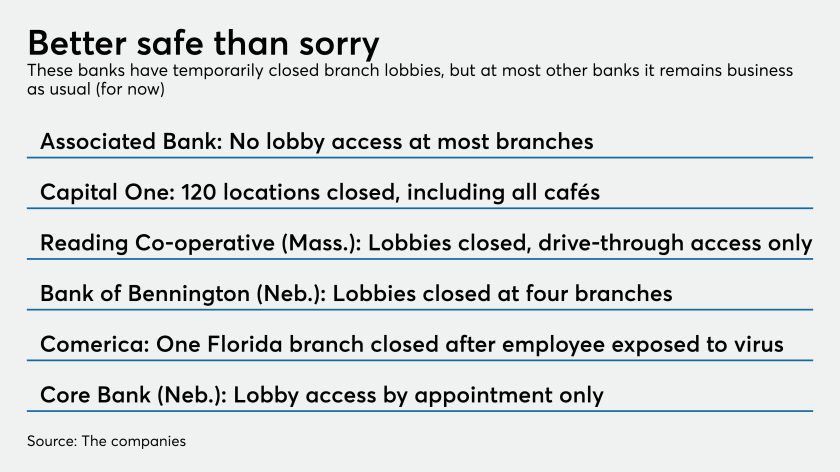

Many institutions said they would close branches, operate drive-throughs only, limit lobby visits to appointments or take other protective steps. Yet others want to stay open to promote public confidence in the banking system.

The Federal Open Market Committee lowered the fed funds rate target to between zero and ¼% in an emergency meeting on Sunday, but while analysts say the move was needed, they feel it will take more to offset the effects of COVID-19.