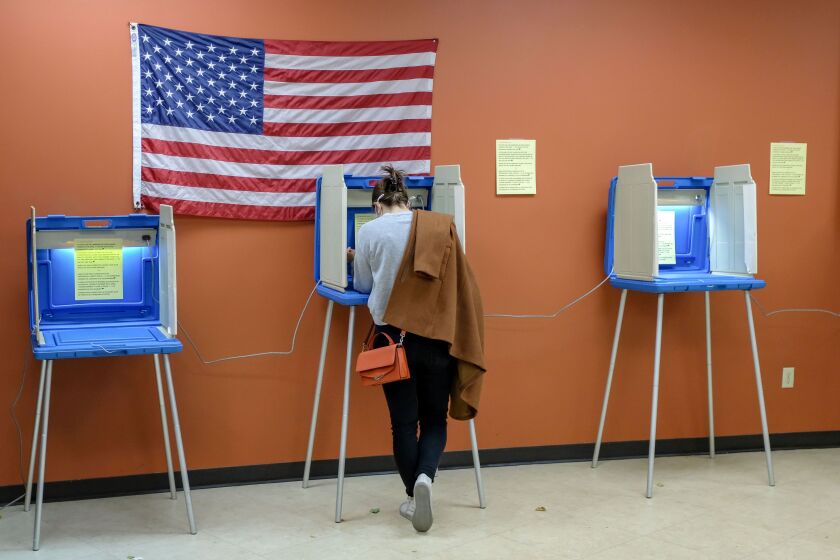

Wages are set to go up in Florida after voters passed a minimum wage ballot initiative in Tuesday’s election.

Despite lingering uncertainty over the U.S. election, the country’s ultra-rich already have plenty to celebrate from Silicon Valley to Illinois.

Having started his transition at the beginning of the pandemic, Board Chair Richard Jones now faces the uncertainty of the presidential election and what Congress might do with accounting standards.

The outcome of Tuesday’s election could be profound tax changes, but that’s only if one party wins control of both houses of Congress and the White House.

As the country looks to make its choice between two decidedly different candidates, tax preparers are watching the race play itself out from a unique vantage point.

Add in the complexities of this year’s presidential race, and we have a recipe for uncertainty and fear.

Former vice president and Democratic presidential candidate Joe Biden’s tax proposal will limit direct tax increases to just 1.9 percent of taxpayers.

This article looks at a few key components of the presidential nominees' tax positions.

Senator Kamala Harris condemned the Trump administration’s handling of the pandemic as the worst failure in U.S. government history, but evaded answers on the Democrats’ positions on the environment and the Supreme Court.

Democratic presidential nominee Joe Biden released his 2019 tax returns hours before the first debate with President Donald Trump, showing that he paid $299,346 in income taxes in 2019.