The president-elect's pledge to repeal President Donald Trump‘s tax cuts as soon as he is inaugurated may be stymied for the foreseeable future.

As the country looks to make its choice between two decidedly different candidates, tax preparers are watching the race play itself out from a unique vantage point.

Add in the complexities of this year’s presidential race, and we have a recipe for uncertainty and fear.

Former vice president and Democratic presidential candidate Joe Biden’s tax proposal will limit direct tax increases to just 1.9 percent of taxpayers.

This article looks at a few key components of the presidential nominees' tax positions.

Senator Kamala Harris condemned the Trump administration’s handling of the pandemic as the worst failure in U.S. government history, but evaded answers on the Democrats’ positions on the environment and the Supreme Court.

Senate leaders will be trying to hold their parties together for a vote Thursday to advance a slimmed-down stimulus bill that Democrats have already rejected, with both sides jockeying for advantage in public perceptions two months before the election.

The Democratic presidential nominee Joe Biden expressed optimism and hope about overcoming the economic crisis and other challenges during his acceptance speech at the virtual Democratic National Convention.

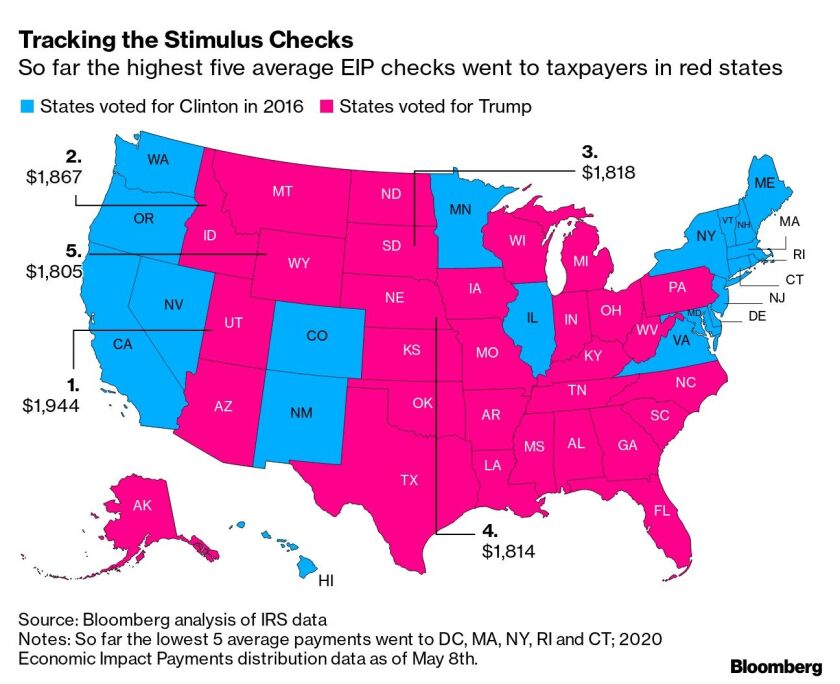

Residents of states such as Utah, Idaho and South Dakota collected average stimulus payments topping $1,800.