Under the new act, some can take out as much as $100,000 from retirement plans early without penalty.

Like other businesses, hospitals have been forced to make instant emergency changes because of the coronavirus. But many hospitals are concurrently getting a rush of demand for service with an unclear revenue stream.

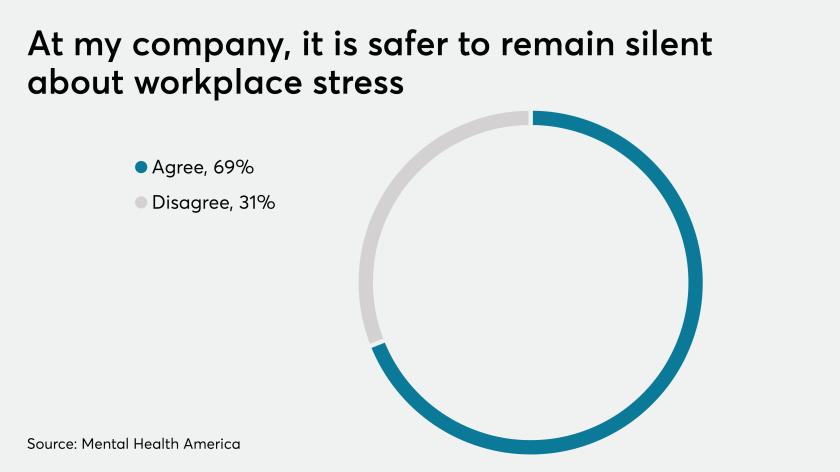

Without the ability to catch early signs of burnout, employers may miss important cues as workers struggle with anxiety and stress.

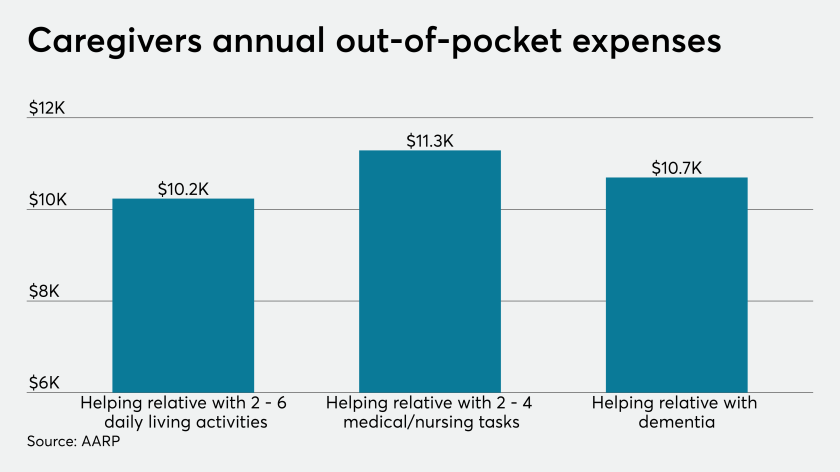

Today’s sandwich generation now looks to employers for support with aging parents. Companies are beginning to add new benefits like work flexibility and care resources.

From Roth conversions to QHFDs: The coronavirus pandemic is forcing difficult questions, and clients rightfully are looking for answers that advisors are uniquely suited to provide.

An integrated healthcare model can treat behavioral health issues more holistically than relying on add-on benefits.

As more U.S. states order widespread shutdowns, small companies provide a test case for the bigger challenges in store.

The employer is also expanding the use of sick time to include caregiving related to COVID-19.

It’s estimated that workplace stress now costs employers $500 billion annually in the form of decreased performance at work or absenteeism.

The passage extends the IRA contribution deadline and waives RMDs for 2020. Here’s what else financial advisors need to know.