The outcomes of two elections in Georgia that are scheduled for Jan. 5 are expected to determine the balance of power in the Senate and may also have an impact on the kind of tax planning that accountants should be advising their clients to do.

During the 2020 presidential campaign, Democratic candidates made many proposals for changes to the Tax Code, ranging from changes to the tax rates to the imposition of a new 5 percent excise tax and a national sales tax.

The Internal Revenue Service is giving taxpayers a break if the checks they mailed in to pay their taxes still haven’t been opened up yet and are sitting in the trailers the IRS set up during the pandemic.

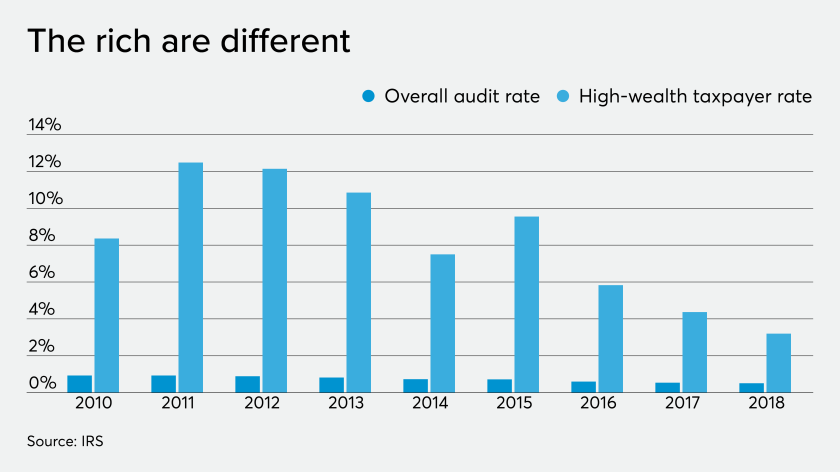

Rich Americans are taking advantage of an unprecedented opportunity, made possible by the coronavirus pandemic, to transfer money to their children and grandchildren tax-free.

The Internal Revenue Service and the Treasury Department are extending a number of tax deadlines for individuals, trusts, estates, corporations and others due to the impact of the novel coronavirus.

The super-wealthy can deploy sophisticated strategies to pass on billions of dollars to their descendants tax-free.