Noninterest income has bolstered profits this year. But its growth is expected to slow over the next two years, making for a gloomy earnings outlook unless vaccine distributions and the economic recovery are relatively swift.

As the pandemic has stretched on further into 2020, with more lockdowns and economic disruption predicted heading into the fall and winter, continuing to offer fee waivers has not always proved financially viable.

The company has established a fund that will provide capital, technical assistance and long-term recovery support to small businesses, especially minority-owned companies. The other megabanks are expected to donate their fees, also.

Banks tend to pull back in times of crisis by tightening credit and focusing on collections efforts. But consumers, and not returns, must be the focus during the coronavirus pandemic.

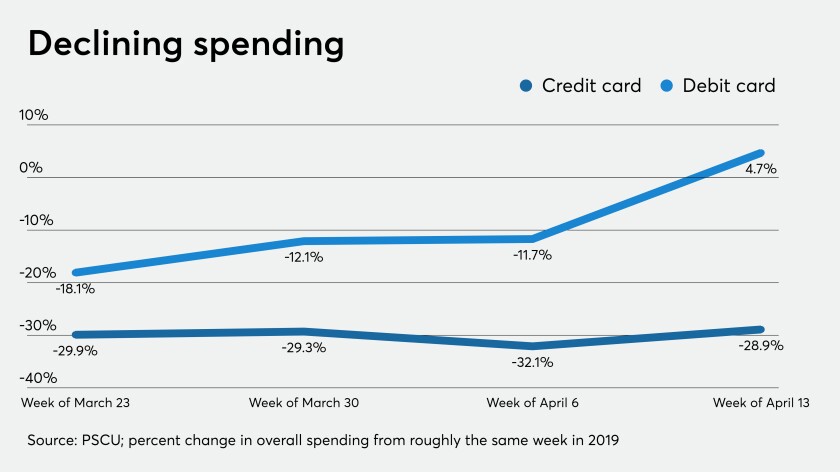

Consumers are using their debit and credit cards less, and that's causing a decline in interchange income for credit unions and banks.

Bankers say they understand the need for an extraordinary government response to the coronavirus outbreak, but worry that even slashing interest rates won’t stimulate demand.