Rep. Pete Olson, a Republican from Texas, has introduced a bill that would offer tax incentives to employers who train workers about best practices for reducing the spread of COVID-19 in the workplace.

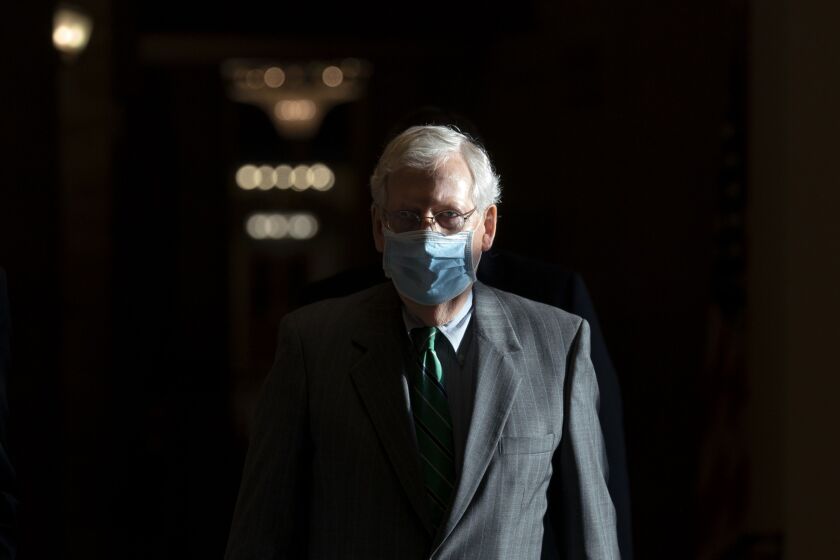

Senate leaders will be trying to hold their parties together for a vote Thursday to advance a slimmed-down stimulus bill that Democrats have already rejected, with both sides jockeying for advantage in public perceptions two months before the election.

Opportunity zones may just be the perfect vehicle to deliver economic relief to the areas hardest hit by the coronavirus pandemic — both short term and long term.

There’s little chance of agreement on a new federal coronavirus relief plan without a compromise on the roughly $1 trillion in aid to beleaguered state and local governments that Democrats demand and the White House opposes.

Democrats are demanding more Republican concessions to meet an end-of-the-week deadline for a deal on pandemic relief, and one of the chief White House negotiators warned there is little time left for negotiations.

White House and Democratic negotiators driving toward a deal on a final massive virus relief package by the end of the week still must overcome a raw mix of election-year pressures, internal GOP splits and a profound lack of trust between the parties.

The emergence of new coronavirus hotspots, especially in the South and West, had a major impact, according to a new report from payroll giant Paychex.

Time is running out for further relief efforts before the August recess.

The GOP legislation includes a second tranche of stimulus payments, structured the same way as the earlier round, in March, along with tax credits for businesses.

The economic stimulus plan released by Senate Republicans offers no new money for states and cities to cope with swelling budget shortfalls, leaving them to contend with a grave financial crisis that’s already forcing them to slash spending, furlough workers and delay projects as tax revenue disappears.