As fear and uncertainty over COVID-19 rapidly grow, it has sent yields for both municipals and Treasuries to never before seen low levels — begging the question if we could see zero or negative yields here in the States?

The world’s pile of negative-yielding debt has grown as the economic backdrop soured and fears of a pandemic mounted.

The bloodbath in risk assets has intensified on deepening concerns about the economic fallout from the spread of the coronavirus.

“Stocks and bonds say we’re doomed,” said Chris Rupkey, chief financial economist for MUFG Union Bank.

We can all play a part in preparing for this and future outbreaks.

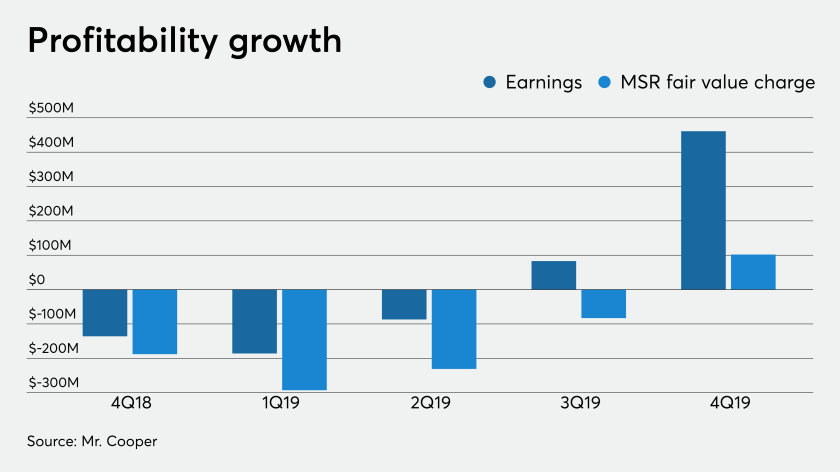

Mr. Cooper Group reported fourth-quarter net income of $461 million, aided by the recovery of its deferred tax asset and a positive mark-to-market on its servicing portfolio.

Other global health threats, such as SARS, did not have long-term impact on stocks. COVID-19 might be another matter.

Fear and worry are rampant. One client asked if any other client had recently returned from China.

A flight to safety that saw funds in short-term bonds and utilities add cash as coronavirus dominated headlines has given way to a vigorous rally.