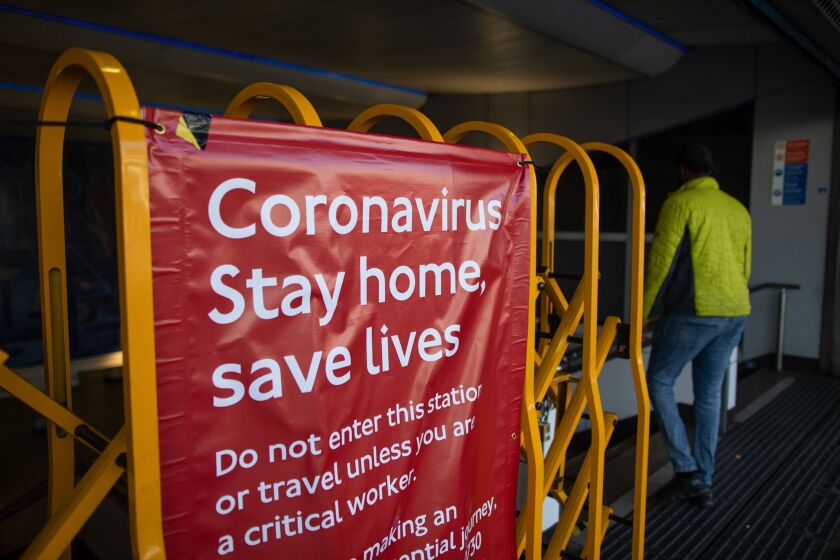

Grant Thornton CEO Brad Preber and principal Linda Miller, who leads the firm’s fraud and financial crimes practice, explain why the coronavirus pandemic and the government response to it have created unique opportunities for fraud.

Even before the coronavirus outbreak, cybercriminals were shifting their attention away from point-of-sale terminals — but the retail industry still absorbs the most attacks seeking to compromise databases or networks.

Discover transitioned all of its 8,000 U.S.-based call center personnel to work from home within a matter of days after the U.S. declared a national emergency on March 13. By March 20, Discover had 95% of its agents working from home using a thin-client device to emulate their call center desktops.

Credit card chargebacks were rising in certain categories prior to the coronavirus outbreak, but the pandemic is causing a spike in all types of payment card disputes.

While the global coronavirus outbreak may be grounding corporate travel to a near standstill, leading travel companies and fintechs are continuing to hone AI-based payments platforms to reduce the problem of corporate travel fraud.

Financial institutions need to alert customers about emails or websites that pretend to offer important COVID-19 information but instead could end up stealing their account numbers or logins.