Several companies said this week they’re slashing expenses as the economy limps along. Others would prefer to keep investing in new technologies and hold off on moves like branch closings to better gauge which changes in consumer behavior will stick.

When it comes to branch cleanliness and mask-wearing, the San Francisco bank is more diligent than its rivals in helping to reduce the spread of coronavirus, according to a new study.

When it comes to branch cleanliness and mask-wearing, the San Francisco bank is more diligent than its rivals in helping to reduce the spread of coronavirus, according to a new study.

The move is part of the effort by banks and other companies to promote racial equity and be more sensitive to the stresses on front-line employees.

The Minneapolis company’s partnership with the Black Business Investment Fund and other community development financial institutions is an example of how banks can fulfill multimillion-dollar pledges aimed at closing the racial wealth gap.

The Federal Reserve, U.S. Mint and financial industry representatives are strongly considering a public call for Americans to deposit their spare change, among other fixes, to get coins circulating again. Meanwhile, banks of all sizes are getting creative at the local level.

Some criticized the Fed’s decision to temporarily lift capital restrictions for megabanks, but the move will help ease the crisis.

The Fed has already eased certain capital requirements in response to the coronavirus pandemic. It should avoid making any further adjustments to the surcharge, which is meant to keep global banks from creating systemic risks.

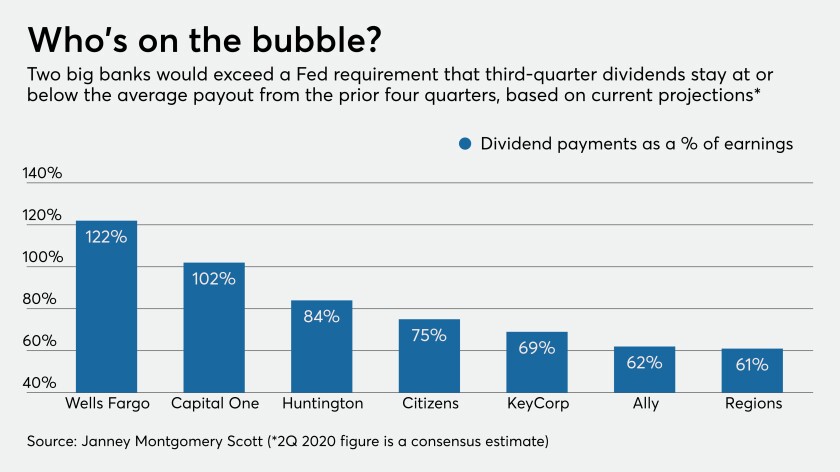

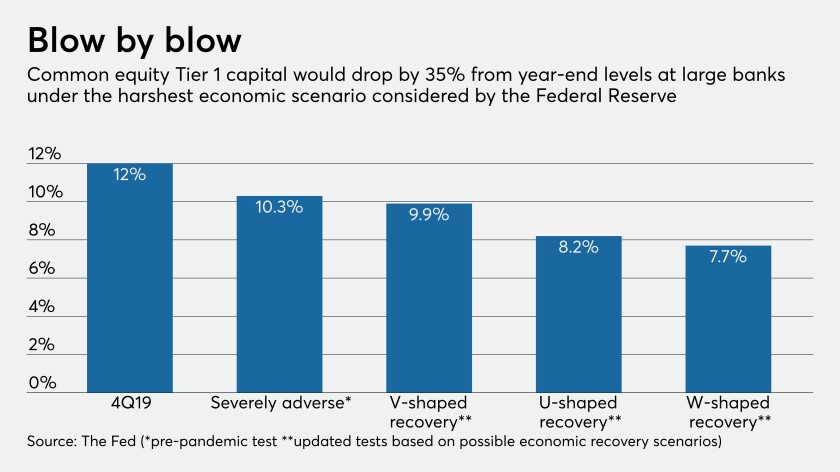

Some observers said the central bank should have suspended dividends entirely in response to an unprecedented economic emergency caused by the pandemic. Others said its more cautious moves were appropriate because big banks' capital is strong and the economy could bounce back.

In the most sweeping capital distribution order since the financial crisis, the Federal Reserve says it will prohibit big banks from buying back their stock in the third quarter and limit dividend payments to second-quarter levels.