The Internal Revenue Service is reversing course on the automatic revocation notices that it sent to more than 30,000 tax-exempt organizations.

Democrats on the House Ways and Means Oversight Subcommittee want the agency to reverse the automated revocation of status for tens of thousands of nonprofits.

Accounting firms Crowe LLP and BKD LLP released year-end tax-planning guides Wednesday, during a time of great uncertainty over future tax changes in the midst of the novel coronavirus pandemic and the upcoming election.

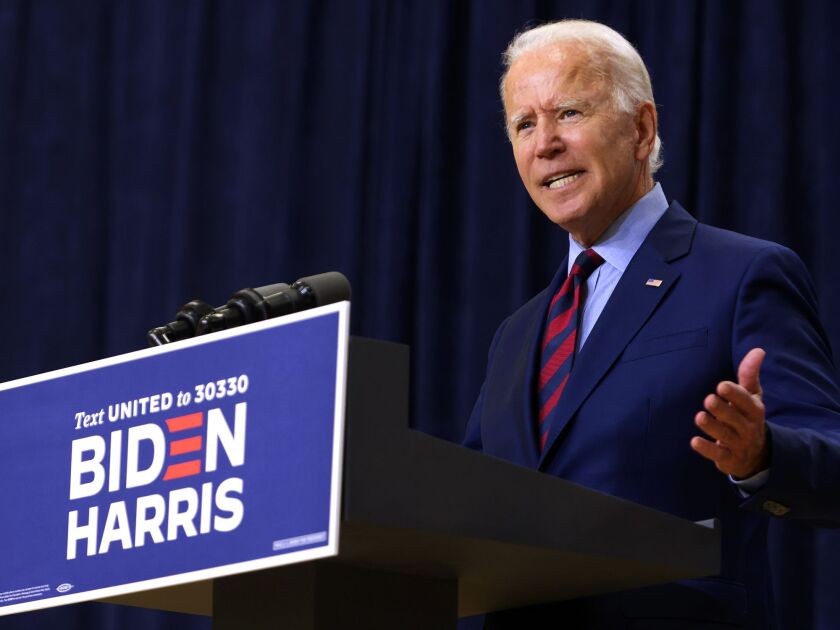

Democratic presidential nominee Joe Biden released his 2019 tax returns hours before the first debate with President Donald Trump, showing that he paid $299,346 in income taxes in 2019.

Several significant changes are probably in store for next tax season.

The Internal Revenue Service has released a draft version of the Form 1040 for tax year 2020 with several significant changes probably in store for next tax season.

Dozens of millionaires from the U.S. and six other countries have a message for their governments: “Tax us. Tax us. Tax us.”

The Senate and House passed bipartisan legislation to help nonprofits remain financially viable during the COVID-19 pandemic.

Business leaders and accountants should understand three significant SALT issues, if they're expecting an increase of remote employees working in new state or local tax jurisdictions this year.

Nonprofits, lawmakers and others want to see more giving from fund donor-advised funds, which have grown popular recently because they’re so flexible.