No-interest loans and overdraft forgiveness are among the lifelines banks are offering to consumers and small businesses whose livelihoods are being upended by the economic fallout.

Investors fear the coronavirus may end the bear market. We check in with dealmakers from Riverside, Merrill Corp. and Paul Hastings about the potential impact on mid-market M&A. In deal news, Pepsi buys Rockstar to expand energy drink line.

Gov. John Bel Edwards kicked off Louisiana's legislative session by asking lawmakers to share accurate details about the coronavirus with constituents.

For risk managers, Covid-19 presents a stark reminder of the need to prepare for threats proactively.

Federal government stimulus measures could be on the way, as volatility in the stock markets continue and coronavirus spreads. We check in with dealmakers from Riverside, Merrill Corp. and Paul Hastings about the potential impact on mid-market M&A. In PE news, Blackstone backs healthcare technology company HealthEdge.

The outbreak and a free fall of oil and stock prices are rattling bankers at this year's ICBA gathering in Orlando, Fla.

S&P Global Ratings is postponing a March 31 forum on public housing bonds due to concerns about the outbreak of COVID-19.

The Metropolitan Pier and Exposition Authority updated its latest offering statement to warn of the risk posed to its bottom line as did two systems with upcoming deals.

More buyers are seeking protection if a target suffers from implications from the coronavirus, a recession or an industry downturn.

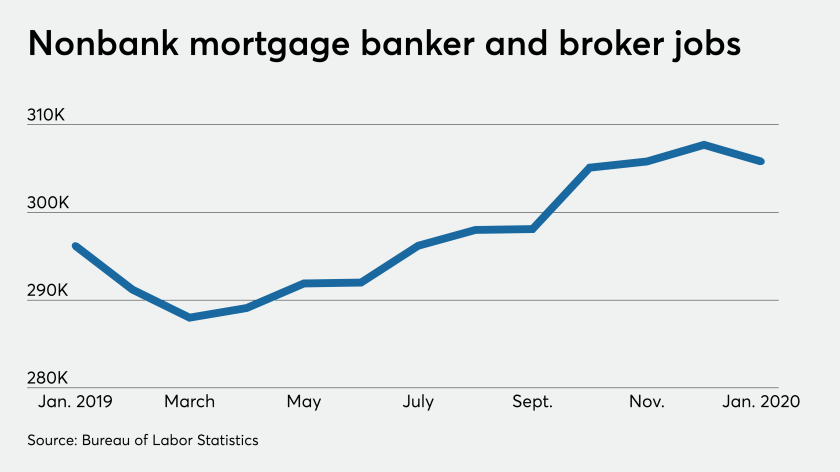

Nonbank mortgage employment fell in January, but could subsequently surge as lenders seek to capture business while rates are low, the job outlook is favorable, and the coronavirus is contained.