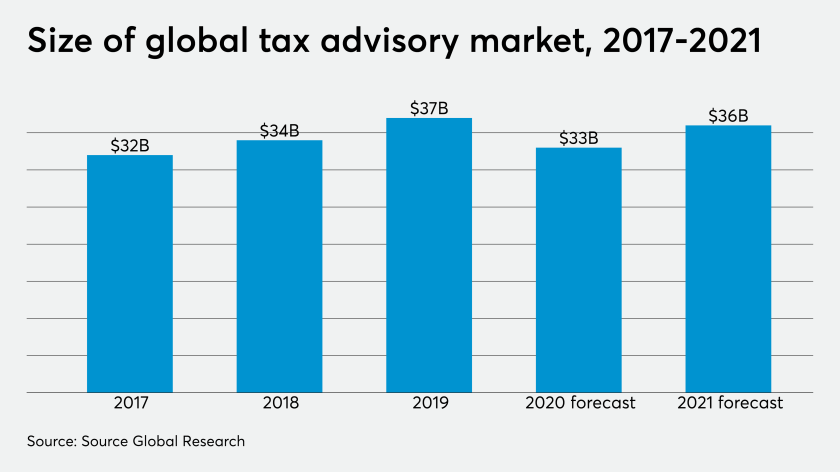

Tax advisory firms took a projected $3 billion hit on their revenues around the world last year because of the coronavirus pandemic, according to a new report.

Eighty percent of the business leaders surveyed by BDO in the Americas said the focus of tax legislation changes constantly as the result of the elected party and/or it is difficult to predict.

Intercompany pricing corrections now can help generate cash by utilizing tax net operating losses.

The outcome of Tuesday’s election could be profound tax changes, but that’s only if one party wins control of both houses of Congress and the White House.

Conversations have already started about how the increased government expenditures to support citizens during the pandemic will be funded. But resisting the urge to increase taxes may be the best way to support economic growth.

PricewaterhouseCoopers has been building its managed tax services business since 2017, but now it sees an opportunity to help companies who are dealing with COVID-19.

The extension also applies to Americans living abroad who would otherwise generally have had a filing deadline of June 15.

Big Four firm Ernst & Young and its business tax clients at companies across the U.S. and other countries have faced a series of challenges amid the pandemic.

Some multinational companies can generate additional carryback tax loss relief through transfer pricing planning.

The Internal Revenue Service and the Treasury Department provided cross-border tax guidance Tuesday to provide relief to individuals and businesses affected by travel disruptions arising from the novel coronavirus pandemic.