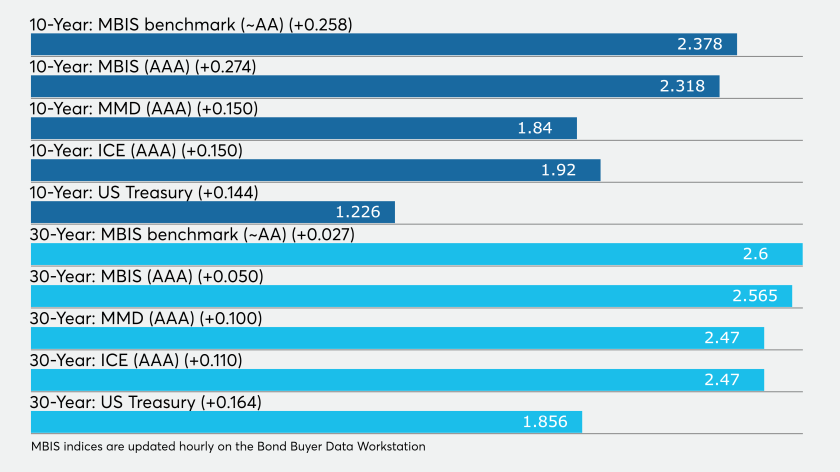

Benchmarks showed again that the short end was being hit hardest — 30 basis points up on the one-year and at least 10 up on the long end, but the entire curve was being cut drastically. The primary market was again at a standstill.

An imagined conversation with the legendary Vanguard founder about the coronavirus market crash.

Questions about the impact of COVID-19 surround the state-run authority, which operates New York City transit and is one of the largest municipal issuers.

Airports have nearly $100 billion in infrastructure debt that requires about $7 billion in airport bond principal and interest payments this year.

Authority Chairman Patrick Foye cited plummeting revenue as riders stay home because of COVID-19

The municipal market is dealing with a major liquidity event, with massive short-end selling.

The Federal Reserve's support for the commercial paper market made clear that it was willing to go beyond cutting interest rates, but the central bank may feel pressure to do even more as the crisis worsens.

Mortgage real estate investment trusts are taking stock of their financial ability to respond to market shocks and other concerns stemming from the coronavirus.

GLWA has the flexibility to come to market as early as this week, but is monitoring the market in light of the COVID-19 impact.

Hotels and restaurants are losing as much as 50% of their business in the District of Columbia due to the coronavirus.