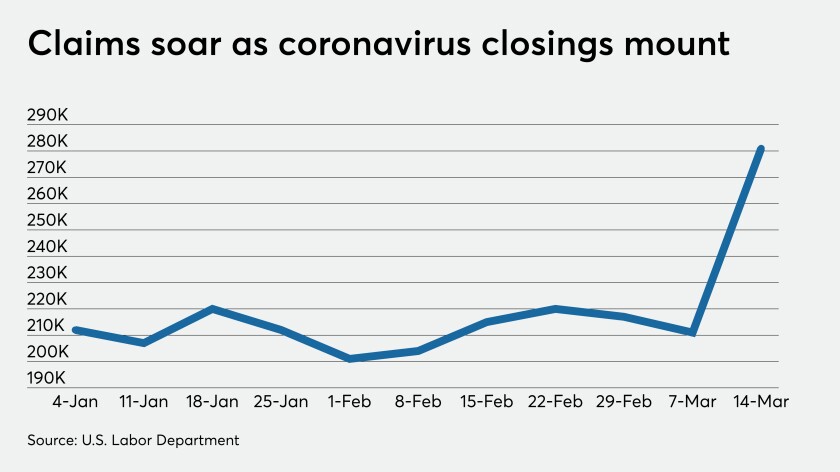

As the Federal Reserve continues trying to keep markets liquid as the stock market sinks, economic data are showing the effects of COVID-19.

The Federal Open Market Committee lowered the fed funds rate target to between zero and ¼% in an emergency meeting on Sunday, but while analysts say the move was needed, they feel it will take more to offset the effects of COVID-19.

For risk managers, Covid-19 presents a stark reminder of the need to prepare for threats proactively.

Private capital fundraising posted a banner year in 2019 led Blackstone closing the largest buyout fund ever. AEI, Vista, Summit, involved in PE-related deals. Houlihan Lokey and Lincoln among top investment banks. Audax and Genstar rank among top PE firms.

Thermo Fisher buys coronavirus test maker Qiagen in biggest healthcare of the deal of the year. Bregal Sagemount raises third fund. In more PE news, AEI, GTCR and FP make deals.

Policymakers may not wait until their mid-month meeting and could act with other central banks.

Stock market volatility underscores fears of global shortages of manufactured goods due to the coronavirus. We check in with dealmakers on the potential impact. Corsair Capital raises fifth fund. Audax, HarbourVest and Genstar named top three most active PE firms in U.S. deals.