Foreign banks for years have been using technology that folds several communication and information-sharing capabilities into one platform. Now Citigroup and others here are showing interest because of the growing importance of digital in the pandemic.

The success of Isbank's Maxi service is a lesson for all banks: Chatbots, with the right training, can provide the kind of human touch customers need in times like these.

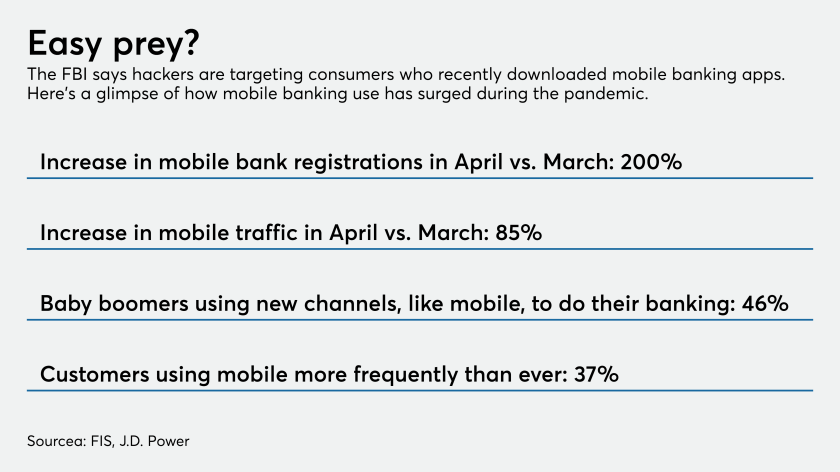

Mobile banking use has swelled since the pandemic hit, and law enforcement officials expect hackers to target the credentials of digital novices. The FBI stressed the importance of two-factor authentication and ensuring consumers know how to spot fake apps that carry malware.

Saul Van Beurden's team is tasked with keeping systems running during the pandemic, including driving equipment to homebound workers. Yet the bank must continue making upgrades demanded by regulators, investing in new technology and recruiting top talent, he says.

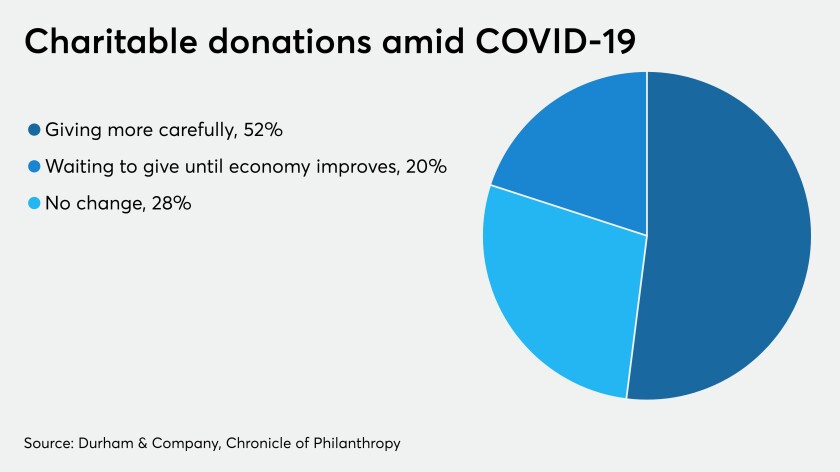

Industry giving is likely to decline in the wake of the pandemic, but it could force the movement to update its giving platforms.

Use of banks' mobile apps and websites has risen about a third since the coronavirus crisis began, according to J.D. Power.

Customers in the challenger bank's pilot program drew down an average of $200 each in advance of the government's $1,200 payments.

Customers are more reliant than ever on digital banking tools, and institutions like OceanFirst, BBVA and M&T are thankful they had invested in teaching employees to show customers how to use them.