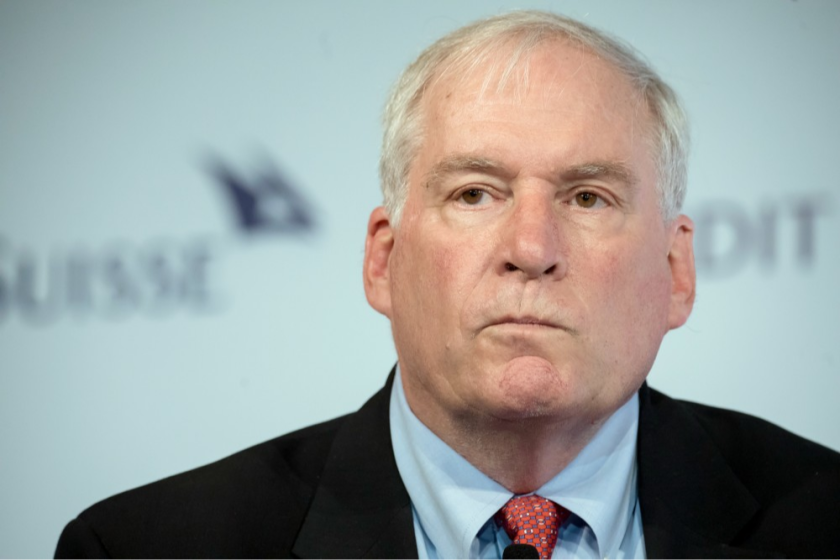

Participation in the Main Street Lending Program for midsize companies is partly about public service, but the core business rationale is building "a banking relationship that continues on for some time," the Boston Fed chief says.

Lawmakers shouldn't let themselves be misled by a slower pace in personal bankruptcy filings so far this year.

While experts predict rates will not stay at zero lower bound as long as after the financial crisis, they don’t see a hike for years.

The Fed allowing use of munis as collateral in its MMLF program won't fix all the problems caused by COVID-19 and may add issues.

The Fed must set up a "family financial facility" that sends billions to households and small businesses so banks don’t misdirect relief funds.

The Federal Open Market Committee lowered the fed funds rate target to between zero and ¼% in an emergency meeting on Sunday, but while analysts say the move was needed, they feel it will take more to offset the effects of COVID-19.

The markets continue to sink on virus fears, as even a 50 basis point rate cut by the Federal Reserve last week didn’t turn the markets around. The Fed meets again next week and many see more easing, but will those efforts prevent recession?

Marc Odo, client portfolio manager at Swan Global Investments, discusses the Federal Reserve’s emergency rate cut, why more easing may not help, the rocky road ahead, and why consumer confidence will be the key indicator to watch. Gary Siegel hosts.

In announcing the central bank’s emergency rate cut, Chairman Jerome Powell warned that the Fed can only do so much.

The Federal Reserve has voted unanimously to cut the interest rate 50 basis points to 1.10% effective March 4, in the first emergency rate cut since 2008.