Forecasts about the pandemic's impact on the mortgage market have grown less dire after forbearance requests by homeowners nearly leveled off in the first half of May.

A Democratic measure to freeze foreclosures and auto repossessions through the coronavirus crisis while expanding eligibility for loan forbearance is getting strong pushback from banks and credit unions, which complain it would constrain credit.

Democrats’ latest proposal to back debt collectors, enable loans for nonprofits and provide other relief could help steer negotiations with the Senate on more stimulus.

Our second monthly survey found a smooth transition to remote work and digital customer access channels — but technology issues still arose. The pandemic has highlighted the importance of having a strong digital presence across all retail sectors, including financial services.

U.S. Bancorp, Wells Fargo, WSFS and others were already deeply engaged in digital transformations before the coronavirus crisis led them to pivot — quickly.

Complaints to the bureau hit an all-time high in April. More than one in five said servicers wouldn't grant deferrals, forced borrowers into forbearance or violated other requirements of the coronavirus relief law.

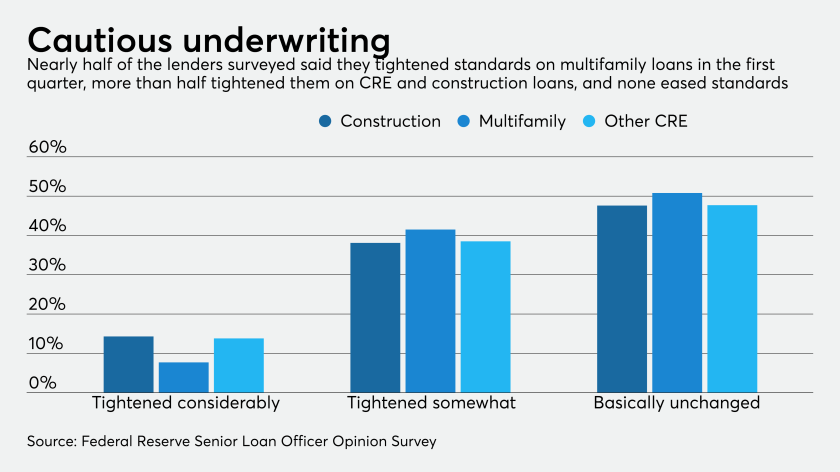

Lenders implemented stricter underwriting across all loan types in the first quarter as the pandemic upended the economy, the Federal Reserve said in its survey of loan officers.

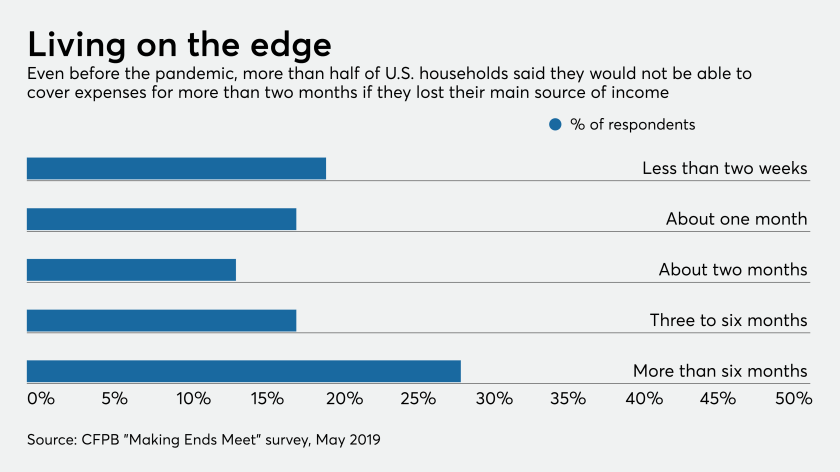

Credit inquiries for auto lending, revolving credit cards and mortgages fell sharply in March as unemployment surged, according to a Consumer Financial Protection Bureau report.

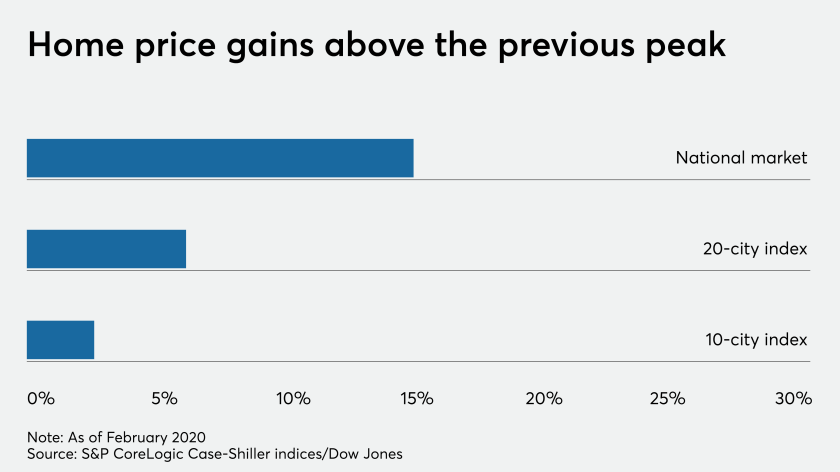

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

The bureau issued an interpretive rule clarifying that consumers under certain conditions can modify or waive waiting periods required by the Truth in Lending Act and Real Estate Settlement Procedures Act.