The recent stimulus law’s relief for renters and extension of the federal eviction ban were meant to ward off a housing crisis. But owners of 1- to 4-unit dwellings still face mounting mortgage and property tax debts, and delinquencies could start rising soon — followed by foreclosures.

Lenders pushed back against the notion that city dwellers' pandemic-driven flight to suburbia would hurt them. They say fewer landlords have sought deferrals as vacancy rates remain low and rent collections have stabilized.

Fitch assumes a significant spike in defaults over the next few months, as well as declining new issuance volume during the second and third quarters of 2020, fewer maturing loans and fewer resolutions by special servicers.

New-home construction exceeded forecasts in February, underscoring momentum in the industry a month before the coronavirus pandemic injected uncertainty into the economy.

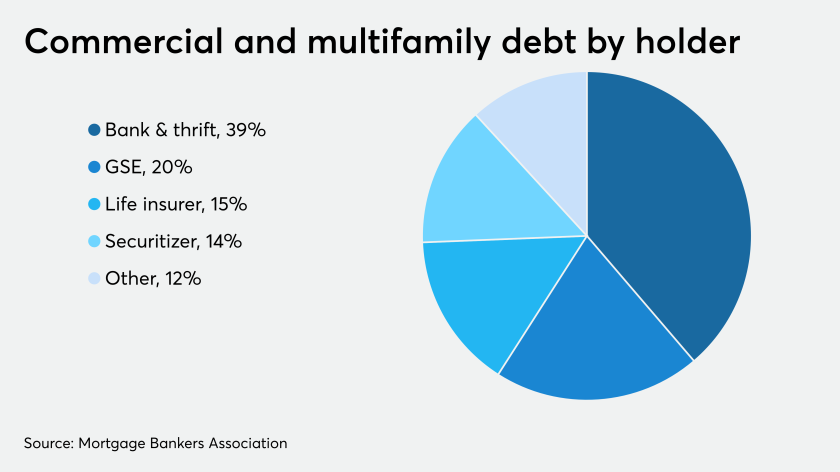

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

Any impact from the coronavirus outbreak on commercial and multifamily loan delinquencies won't be known for some time, the Mortgage Bankers Association said.