A public-private partnership that has fewer rules and restrictions than the Paycheck Protection Program would save more small businesses.

Mortgage technology efforts have historically been behind the curve, but some recent responses to the coronavirus highlight instances where it rises to the occasion.

The government is cushioning the impact of the coronavirus on consumers, but independent mortgage bankers need funding to deal with increased levels of servicing advances because of forbearances.

Banks may be protected from a direct hit, but they have invested in vehicles that include such loans, potentially exposing them to defaults.

Mortgage companies that borrow heavily to keep their operations running may face financial pressure from coronavirus-related market volatility as it affects the valuations of collateral securing their financing.

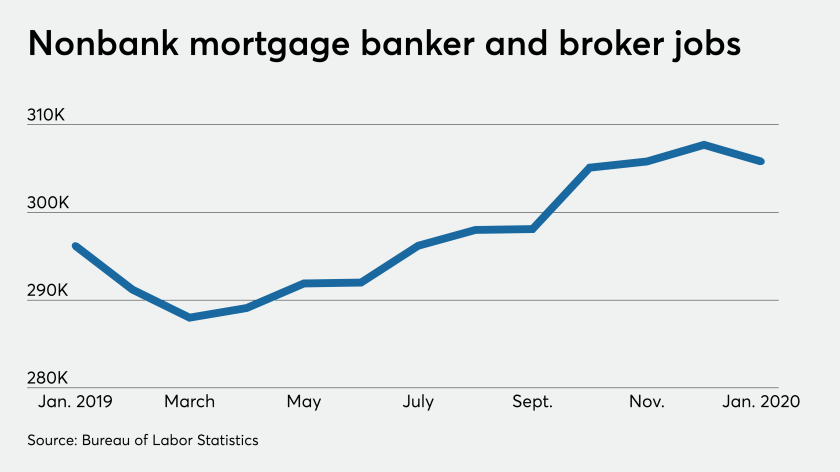

Nonbank mortgage employment fell in January, but could subsequently surge as lenders seek to capture business while rates are low, the job outlook is favorable, and the coronavirus is contained.