Bank bill-payment sites have become less relevant over the last decade as more people go to billers’ websites to pay directly or use billers' mobile apps — often at the last minute. But the COVID-19 pandemic could flip the script on the $4.6 trillion bill-payment sector.

COVID-19 has accelerated changes in payments behavior that would otherwise have taken years to occur, laying the foundation for global expansion post-pandemic. But for different parts of the world, this digital transformation had very different outcomes.

The pandemic has upended many business tasks, creating a rush among processors to expand the digital experience without complicating it.

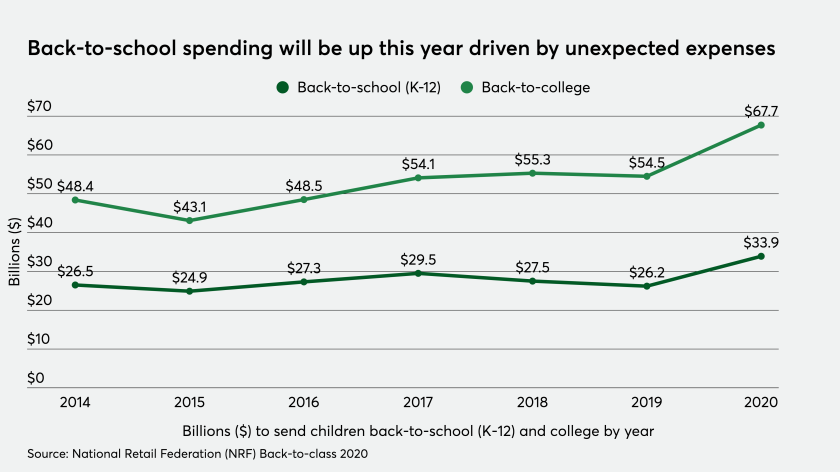

One thing that many parents are finding unusual this year is the amount of money being spent on school supplies during the coronavirus crisis — it’s actually going up.

Square's gross payment volume tumbled by 15% year-over-year due to COVID-19’s impact, but revenue jumped as online selling rose, Cash App doubled in users and Square enabled almost $900 million in PPP loans.

The company's results put firm numbers on one of the most discussed business trends of the pandemic economy — the acceleration of digital payments.

The coronavirus outbreak has caused economic activity to crater, and Visa says its focus on services, partnerships and e-commerce has provided stability and a route to growth.

Universities are facing the same uncertainties as any other business during the coronavirus pandemic. This is especially true for universities that cater to international students.

Businesses affected by the pandemic are accepting online and touchless in-person payments from consumers with the help of technologies developed originally for B2B invoicing and payments.

Brick-and-mortar merchants that have shifted to online have changed their risk profile, causing conflicts with the fintechs like Square that handle their payments. And that could be an opportunity for banks.