Time is running out for further relief efforts before the August recess.

The pressure is on the fintech, which helps banks make digital loans, to stanch its losses and show its lofty market valuation was deserved.

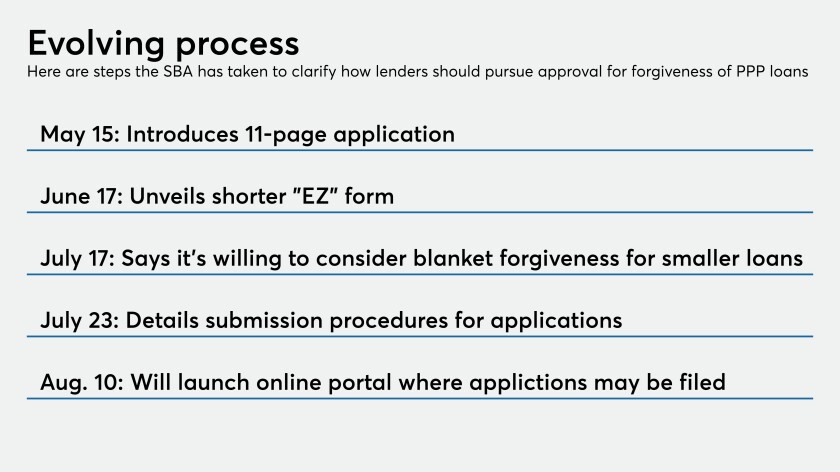

A new Small Business Administration notice explains what steps lenders must take to seek approval of their forgiveness decisions under the Paycheck Protection Program. But lenders say lawmakers and regulators must do more to cut red tape.

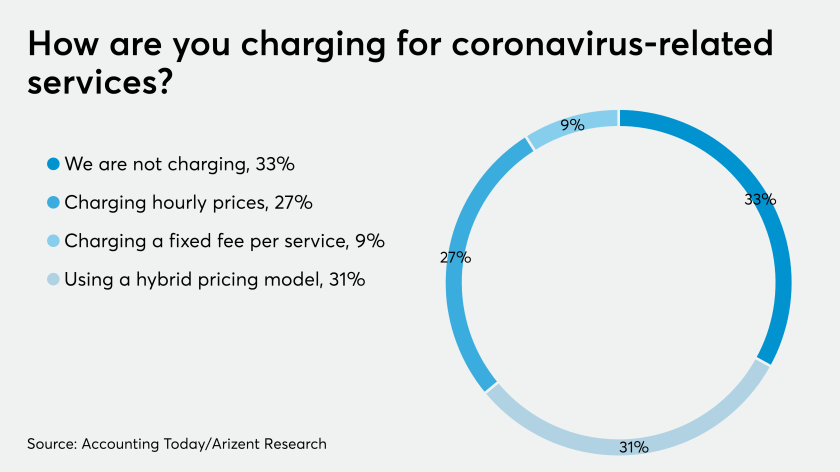

Firms may want to trade short-term cash for long-term goodwill.

The American Institute of CPAs offered six policy suggestions for the next phase of federal COVID-19 relief legislation under consideration in Congress.

The speed and scale of the Paycheck Protection Program made it particularly susceptible to fraud, explains Juliette Gust, a forensic accountant and founder of Ethics Suite -- and that means businesses need to take steps to protect themselves.

The company has established a fund that will provide capital, technical assistance and long-term recovery support to small businesses, especially minority-owned companies. The other megabanks are expected to donate their fees, also.

The American Institute of CPAs has organized a coalition of 21 business trade groups to push for help for businesses' short-term liquidity needs.

The Trump administration released details of almost 4.9 million loans to businesses – from sole proprietors to restaurant and hotel chains – under the federal government’s largest coronavirus relief program so far, the $669 billion Paycheck Protection Program.

With a resurgence of the coronavirus threatening a nascent rebound of the U.S. economy, the White House and Congress are under increased pressure to come to terms on another round of stimulus.