Bill Smith, managing director of the National Tax Office of CBIZ MHM, discusses the loan forgiveness provisions of the PPP, along with the employee retention credit, net operating loss carrybacks and economic impact payments, along with the prospects for the next round of stimulus in Washington.

The House voted Thursday to give small businesses financially strapped by the COVID-19 crisis more flexibility to spend forgivable loans for payrolls and expenses from the government’s popular Paycheck Protection Program.

The measure, which garnered near-unanimous support, would triple the period during which businesses can spend their coronavirus relief funds and make it easier for loans to be forgiven.

The SBA’s form clarifies some issues, but still leaves questions to be answered.

Tosha Anderson of The Charity CFO shares the strategies that not-for-profit organizations are taking to weather COVID-19.

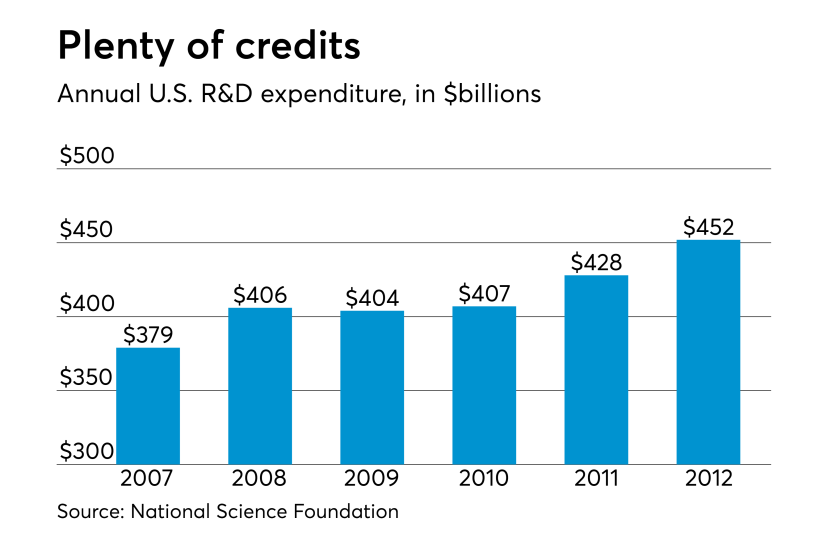

Research credits could look very different for some companies in 2020 compared to other years.

Bankers have become more uncertain about how to serve marijuana businesses owing to confusion about which states deem them essential.

The release of the SBA's loan forgiveness application highlights the questions that remain around the Paycheck Protection Program.

The Treasury Department and the Small Business Administration released an interim final rule after posting the loan forgiveness application.

Jennifer Roberts, the company's head of business banking, details a process to have units work one-on-one with customers to get Paycheck Protection Program funds deployed faster.