Drive-thru is almost synonymous with fast food, but for some quick-serve chains — like Subway — a past emphasis on in-store dining meant a much sharper pivot when the coronavirus pandemic struck.

As the pandemic has stretched on further into 2020, with more lockdowns and economic disruption predicted heading into the fall and winter, continuing to offer fee waivers has not always proved financially viable.

COVID-19 has accelerated changes in payments behavior that would otherwise have taken years to occur, laying the foundation for global expansion post-pandemic. But for different parts of the world, this digital transformation had very different outcomes.

The pandemic has upended many business tasks, creating a rush among processors to expand the digital experience without complicating it.

With consumers and merchants alike sharing the need to be paid faster, the case for adopting real-time payments globally has quickly advanced during the COVID-19 pandemic.

The COVID-19 pandemic has teed up a growth opportunity for the buy now, pay later (BNPL) financial industry, as recession worries made people receptive to entering short-term payment plans that can fit in a budget.

The point of sale terminal industry was already under pressure to go digital before the coronavirus pandemic made this transition much more crucial to its survival.

The major card networks have heavily invested in broader services as transaction processing loses its luster, a strategy that’s provided a ray of hope as retail and travel industries remain sidelined.

Republicans and Democrats are negotiating a new coronavirus stimulus package, but there’s still no law on the books designed to erase the problems that prevented many stimulus payments from getting directly to recipients.

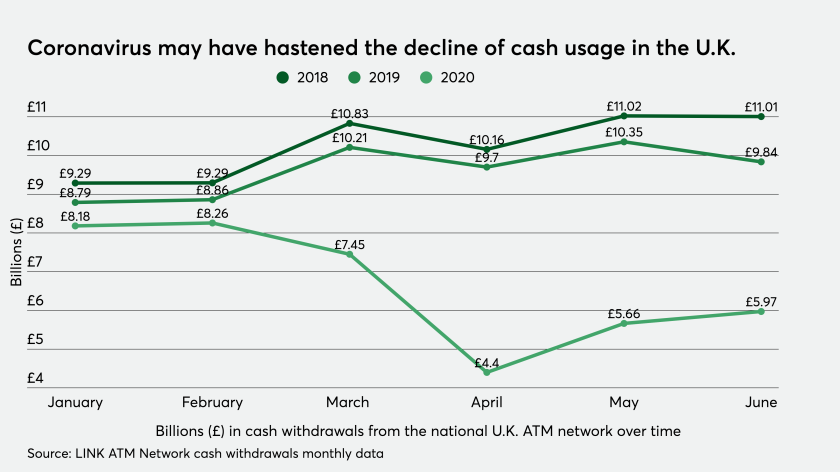

The coronavirus pandemic has cast a shadow over the use of cash, which is often perceived as dirty because it frequently changes hands and is almost never washed.