Drive-thru is almost synonymous with fast food, but for some quick-serve chains — like Subway — a past emphasis on in-store dining meant a much sharper pivot when the coronavirus pandemic struck.

Bank bill-payment sites have become less relevant over the last decade as more people go to billers’ websites to pay directly or use billers' mobile apps — often at the last minute. But the COVID-19 pandemic could flip the script on the $4.6 trillion bill-payment sector.

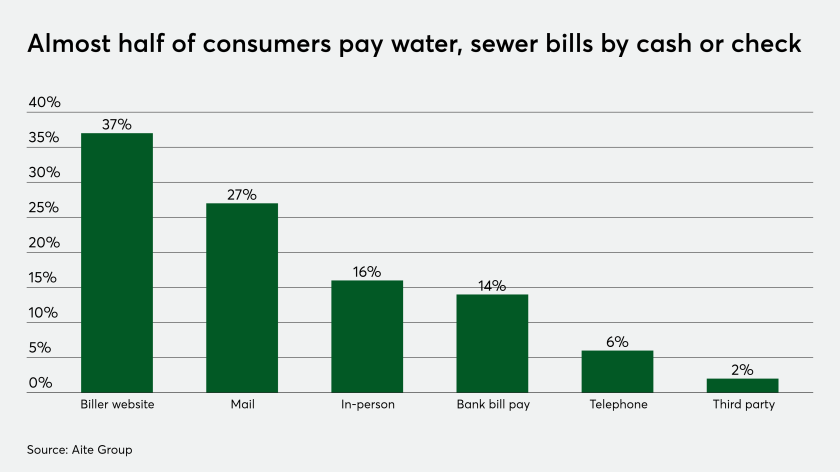

For many U.S. cities and counties, the high number of walk-in payments and checks typically received for services, permits and fees has been aggravating but acceptable — until coronavirus struck.

As the pandemic has stretched on further into 2020, with more lockdowns and economic disruption predicted heading into the fall and winter, continuing to offer fee waivers has not always proved financially viable.

COVID-19 has accelerated changes in payments behavior that would otherwise have taken years to occur, laying the foundation for global expansion post-pandemic. But for different parts of the world, this digital transformation had very different outcomes.

The humble QR code — invented for automobile manufacturing in 1994 — had been on the rise as a payment method for many years, but the pandemic expanded its use in the U.S. in some unforeseen ways.

The pandemic has upended many business tasks, creating a rush among processors to expand the digital experience without complicating it.

Dodger Stadium looks odd now — filled with fake crowd noise and cardboard cutout spectators — but in this downtime it's putting in an almost entirely invisible 5G wireless connection and new point of sale system.

Discover is working to help Black-owned businesses and other merchants maintain foot traffic — safely — through the use of the card network's payments technology and its marketing heft.

When the coronavirus pandemic forced teachers and students to move classroom learning online this year, school districts and educators suddenly faced a raft of challenges around handling new expenses for tools needed for cyber education.