The company's results put firm numbers on one of the most discussed business trends of the pandemic economy — the acceleration of digital payments.

The coronavirus outbreak has caused economic activity to crater, and Visa says its focus on services, partnerships and e-commerce has provided stability and a route to growth.

Republicans and Democrats are negotiating a new coronavirus stimulus package, but there’s still no law on the books designed to erase the problems that prevented many stimulus payments from getting directly to recipients.

Bill Clerico created WePay during the last financial crisis, and sees a similar opportunity now. The coronavirus pandemic is affecting different markets in vastly different ways, and easing the flow of capital is just one way to provide help.

Checkout-free stores still feel experimental, but the coronavirus pandemic is pushing more retailers to contemplate how to reduce human interaction in larger settings.

Three months ago, Stephen Squeri, the chairman and CEO of American Express, declared a global "economic free fall" due to the coronavirus. Its second-quarter earnings show how far a fall it has been.

Universities are facing the same uncertainties as any other business during the coronavirus pandemic. This is especially true for universities that cater to international students.

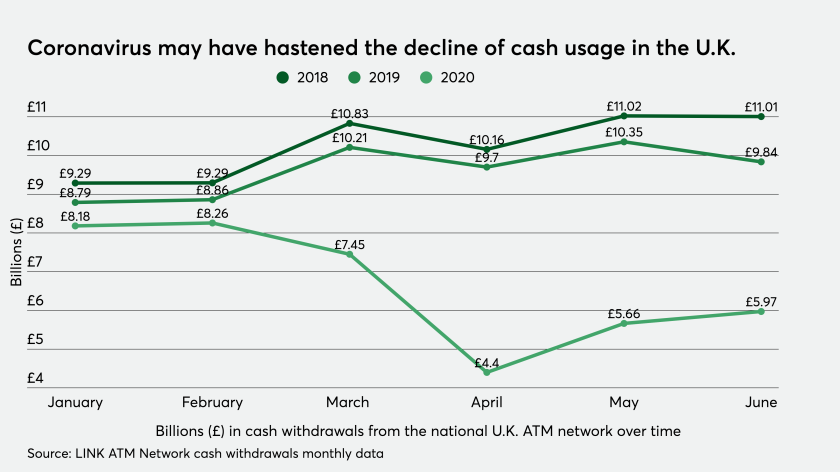

The coronavirus pandemic has cast a shadow over the use of cash, which is often perceived as dirty because it frequently changes hands and is almost never washed.

The growth in remittance providers' digital customer sign-ups accelerated as the U.S. went into a nationwide lockdown in the middle of March, and has continued through the summer despite store reopenings that could pull customers back to their old habits of paying in person.

Mass transit usage cratered during the coronavirus pandemic, but there’s signs of recovery based on how people are paying for their fares.