Drive-thru is almost synonymous with fast food, but for some quick-serve chains — like Subway — a past emphasis on in-store dining meant a much sharper pivot when the coronavirus pandemic struck.

COVID-19 has accelerated changes in payments behavior that would otherwise have taken years to occur, laying the foundation for global expansion post-pandemic. But for different parts of the world, this digital transformation had very different outcomes.

The pandemic has upended many business tasks, creating a rush among processors to expand the digital experience without complicating it.

The COVID-19 pandemic has teed up a growth opportunity for the buy now, pay later (BNPL) financial industry, as recession worries made people receptive to entering short-term payment plans that can fit in a budget.

The point of sale terminal industry was already under pressure to go digital before the coronavirus pandemic made this transition much more crucial to its survival.

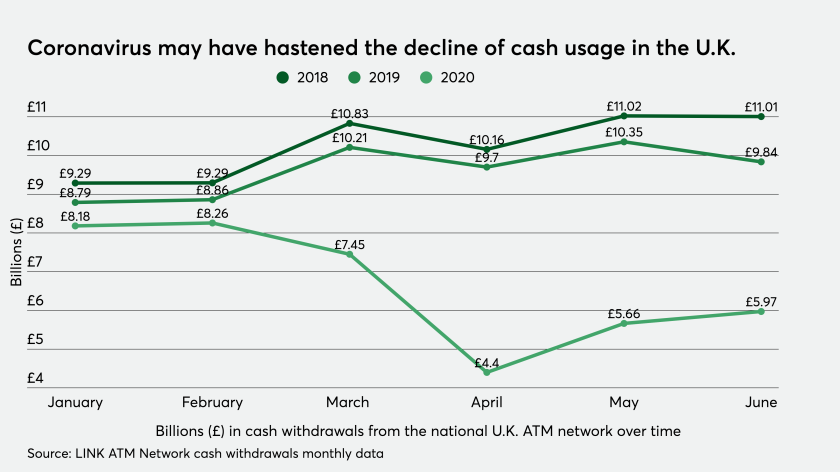

The coronavirus pandemic has cast a shadow over the use of cash, which is often perceived as dirty because it frequently changes hands and is almost never washed.

The coronavirus’ economic fallout has drawn more attention to buy-now-pay-later options, leading to fresh creativity in business models and marketing.

The immediate lockdown of the nation’s economy in response to attempts to flatten the coronavirus infection curve has had a widespread impact on the revenues of all businesses, particularly small ones that are more susceptible to economic disruptions.

Even before the coronavirus outbreak, cybercriminals were shifting their attention away from point-of-sale terminals — but the retail industry still absorbs the most attacks seeking to compromise databases or networks.

A mix of consumer debt and economic anxiety is shining a light on firms that offer alternatives to revolving credit. This, in turn, creates a chance to further tie financing directly to checkout.