Bond yields are shooting up for the second time in as many months. Federal Reserve Gov. Christopher Waller attributes the volatility to concerns about rising national debt levels.

Leaders of the Big Four CPA firms and major companies are stepping in and asking Congress to allow a smooth transition to the Biden administration.

The president-elect's pledge to repeal President Donald Trump‘s tax cuts as soon as he is inaugurated may be stymied for the foreseeable future.

As the country looks to make its choice between two decidedly different candidates, tax preparers are watching the race play itself out from a unique vantage point.

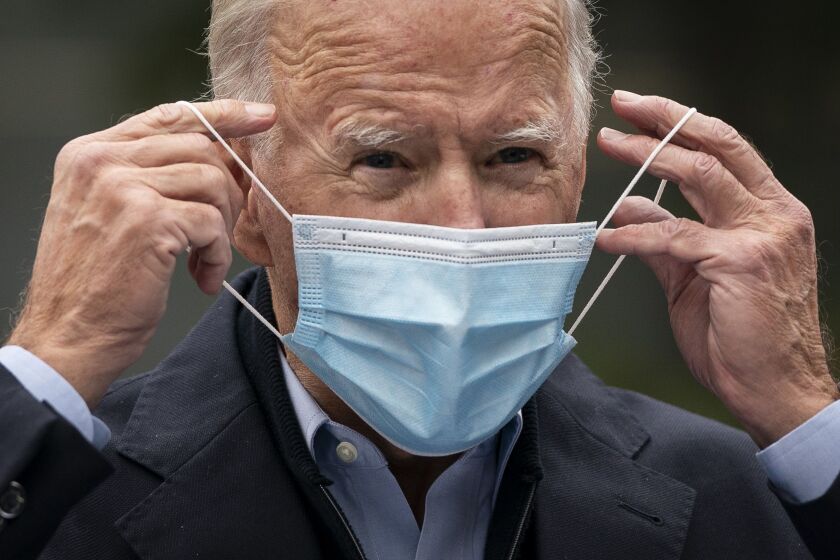

Former vice president and Democratic presidential candidate Joe Biden’s tax proposal will limit direct tax increases to just 1.9 percent of taxpayers.

This article looks at a few key components of the presidential nominees' tax positions.

Senator Kamala Harris condemned the Trump administration’s handling of the pandemic as the worst failure in U.S. government history, but evaded answers on the Democrats’ positions on the environment and the Supreme Court.

Democratic presidential nominee Joe Biden released his 2019 tax returns hours before the first debate with President Donald Trump, showing that he paid $299,346 in income taxes in 2019.

During the 2020 presidential campaign, Democratic candidates made many proposals for changes to the Tax Code, ranging from changes to the tax rates to the imposition of a new 5 percent excise tax and a national sales tax.

At least 39 states did not have enough money to pay all of their bills at the end of 2019, leaving them ill-prepared to shoulder the costs of the novel coronavirus pandemic, according to a new report.